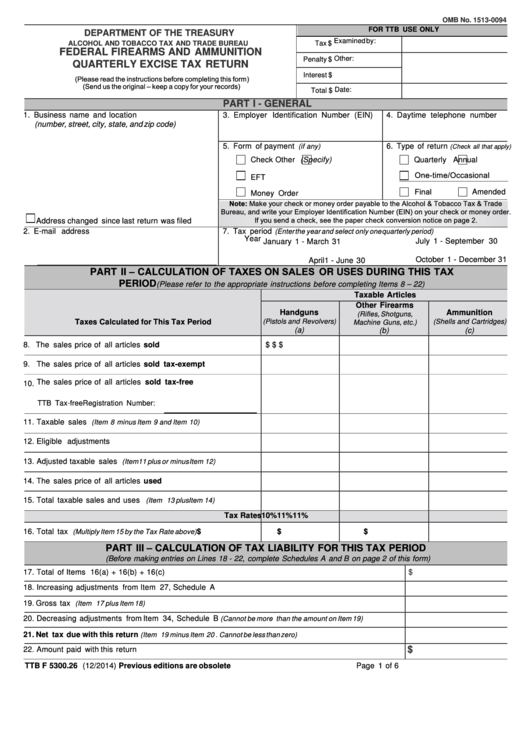

OMB No. 1513-0094

FOR TTB USE ONLY

DEPARTMENT OF THE TREASURY

Examined by:

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

Tax $

FEDERAL FIREARMS AND AMMUNITION

Other:

Penalty $

QUARTERLY EXCISE TAX RETURN

Interest $

(Please read the instructions before completing this form)

(Send us the original – keep a copy for your records)

Date:

Total $

PART I - GENERAL

1. Business name and location

3. Employer Identification Number (EIN)

4. Daytime telephone number

(number, street, city, state, and zip code)

5. Form of payment

6.

Type of return

(if any)

(Check all that apply )

Check

Other (Specify)

Quarterly

Annual

One-time/Occasional

EFT

Final

Amended

Money Order

Note: Make your check or money order payable to the Alcohol & Tobacco Tax & Trade

Bureau, and write your Employer Identification Number (EIN) on your check or money order.

If you send a check, see the paper check conversion notice on page 2.

Address changed since last return was filed

2. E-mail address

7. Tax period

(Enter the year and select only one quarterly period)

Year

July 1 - September 30

January 1 - March 31

October 1 - December 31

April 1 - June 30

PART II – CALCULATION OF TAXES ON SALES OR USES DURING THIS TAX

PERIOD

(Please refer to the appropriate instructions before completing Items 8 – 22)

Taxable Articles

Other Firearms

Handguns

Ammunition

(Rifles, Shotguns,

Taxes Calculated for This Tax Period

(Pistols and Revolvers)

(Shells and Cartridges)

Machine Guns, etc.)

(a)

(b)

(c)

8. The sales price of all articles sold

$

$

$

9. The sales price of all articles sold tax-exempt

10. The sales price of all articles sold tax-free

TTB Tax-free Registration Number:

11. Taxable sales

(Item 8 minus Item 9 and Item 10)

12. Eligible adjustments

13. Adjusted taxable sales

(Item 11 plus or minus Item 12)

14. The sales price of all articles used

15. Total taxable sales and uses

(Item 13 plus Item 14)

Tax Rates

10%

11%

11%

16. Total tax

$

$

$

(Multiply Item 15 by the Tax Rate above)

PART III – CALCULATION OF TAX LIABILITY FOR THIS TAX PERIOD

(Before making entries on Lines 18 - 22, complete Schedules A and B on page 2 of this form)

17. Total of Items 16(a) + 16(b) + 16(c)

$

18. Increasing adjustments from Item 27, Schedule A

19. Gross tax

(Item 17 plus Item 18)

20. Decreasing adjustments from Item 34, Schedule B

(Cannot be more than the amount on Item 19)

21. Net tax due with this return

(Item 19 minus Item 20 . Cannot be less than zero)

$

22. Amount paid with this return

TTB F 5300.26 (12/2014)

Previous editions are obsolete

Page 1 of 6

1

1 2

2