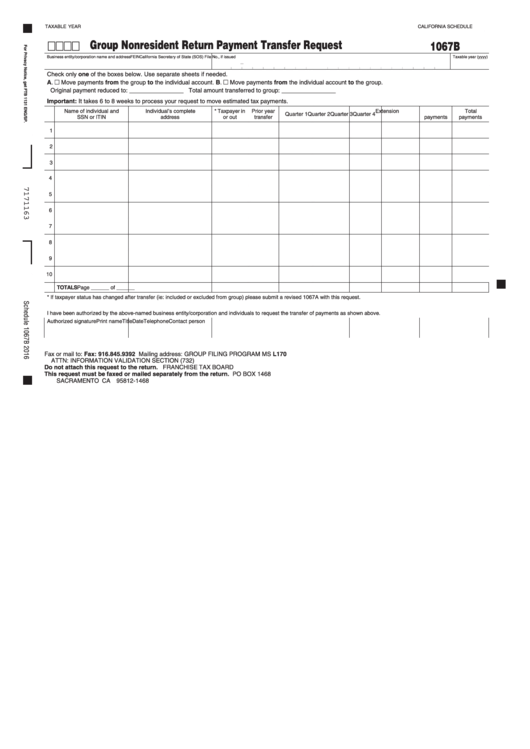

California Schedule 1067b - Group Nonresident Return Payment Transfer Request - 2016

ADVERTISEMENT

TAXABLE YEAR

CALIFORNIA SCHEDULE

Group Nonresident Return Payment Transfer Request

1067B

Business entity/corporation name and address

FEIN

-

California Secretary of State (SOS) File No ., if issued

Taxable year (yyyy)

Check only one of the boxes below . Use separate sheets if needed .

A . Move payments from the group to the individual account .

B . Move payments from the individual account to the group .

Original payment reduced to: ________________

Total amount transferred to group: ________________

Important: It takes 6 to 8 weeks to process your request to move estimated tax payments .

Name of individual and

Individual’s complete

* Taxpayer in

Prior year

Extension

Total

Quarter 1

Quarter 2

Quarter 3

Quarter 4

SSN or ITIN

address

or out

transfer

payments

payments

1

2

3

4

5

6

7

8

9

10

TOTALS

Page ______ of ______

* If taxpayer status has changed after transfer (ie: included or excluded from group) please submit a revised 1067A with this request .

I have been authorized by the above-named business entity/corporation and individuals to request the transfer of payments as shown above.

Authorized signature

Print name

Title

Date

Telephone

Contact person

Fax or mail to:

Fax: 916.845.9392

Mailing address:

GROUP FILING PROGRAM MS L170

ATTN: INFORMATION VALIDATION SECTION (732)

Do not attach this request to the return.

FRANCHISE TAX BOARD

This request must be faxed or mailed separately from the return.

PO BOX 1468

SACRAMENTO CA 95812-1468

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1