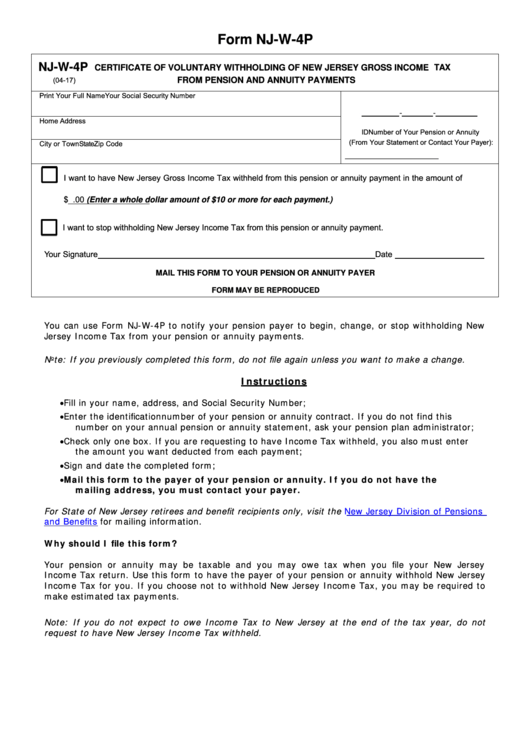

Form NJ-W-4P

NJ-W-4P

CERTIFICATE OF VOLUNTARY WITHHOLDING OF NEW JERSEY GROSS INCOME TAX

(04-17)

FROM PENSION AND ANNUITY PAYMENTS

Print Your Full Name

Your Social Security Number

-

-

Home Address

ID Number of Your Pension or Annuity

(From Your Statement or Contact Your Payer):

City or Town

State

Zip Code

________________________

I want to have New Jersey Gross Income Tax withheld from this pension or annuity payment in the amount of

$

.00 (Enter a whole dollar amount of $10 or more for each payment.)

I want to stop withholding New Jersey Income Tax from this pension or annuity payment.

Your Signature

Date

MAIL THIS FORM TO YOUR PENSION OR ANNUITY PAYER

FORM MAY BE REPRODUCED

You can use Form NJ-W-4P to notify your pension payer to begin, change, or stop withholding New

Jersey Income Tax from your pension or annuity payments.

Note: If you previously completed this form, do not file again unless you want to make a change.

Instructions

Fill in your name, address, and Social Security Number;

Enter the identification number of your pension or annuity contract. If you do not find this

number on your annual pension or annuity statement, ask your pension plan administrator;

Check only one box. If you are requesting to have Income Tax withheld, you also must enter

the amount you want deducted from each payment;

Sign and date the completed form;

Mail this form to the payer of your pension or annuity. If you do not have the

mailing address, you must contact your payer.

For State of New Jersey retirees and benefit recipients only, visit the

New Jersey Division of Pensions

and Benefits

for mailing information.

Why should I file this form?

Your pension or annuity may be taxable and you may owe tax when you file your New Jersey

Income Tax return. Use this form to have the payer of your pension or annuity withhold New Jersey

Income Tax for you. If you choose not to withhold New Jersey Income Tax, you may be required to

make estimated tax payments.

Note: If you do not expect to owe Income Tax to New Jersey at the end of the tax year, do not

request to have New Jersey Income Tax withheld.

1

1