Form E-Actop - Actuarial Opinion "Financial Hardship" Exemption Application - Department Of Insurance

ADVERTISEMENT

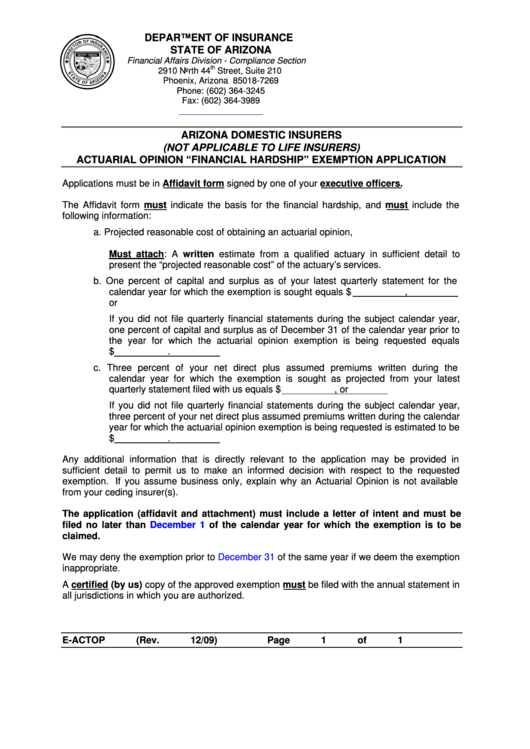

DEPARTMENT OF INSURANCE

STATE OF ARIZONA

Financial Affairs Division - Compliance Section

th

2910 North 44

Street, Suite 210

Phoenix, Arizona 85018-7269

Phone: (602) 364-3245

Fax: (602) 364-3989

ARIZONA DOMESTIC INSURERS

(NOT APPLICABLE TO LIFE INSURERS)

ACTUARIAL OPINION “FINANCIAL HARDSHIP” EXEMPTION APPLICATION

Applications must be in Affidavit form signed by one of your executive officers.

The Affidavit form must indicate the basis for the financial hardship, and must include the

following information:

a. Projected reasonable cost of obtaining an actuarial opinion,

Must attach: A written estimate from a qualified actuary in sufficient detail to

present the “projected reasonable cost” of the actuary’s services.

b. One percent of capital and surplus as of your latest quarterly statement for the

calendar year for which the exemption is sought equals $

,

or

If you did not file quarterly financial statements during the subject calendar year,

one percent of capital and surplus as of December 31 of the calendar year prior to

the year for which the actuarial opinion exemption is being requested equals

$

.

c. Three percent of your net direct plus assumed premiums written during the

calendar year for which the exemption is sought as projected from your latest

quarterly statement filed with us equals $

, or

If you did not file quarterly financial statements during the subject calendar year,

three percent of your net direct plus assumed premiums written during the calendar

year for which the actuarial opinion exemption is being requested is estimated to be

$

.

Any additional information that is directly relevant to the application may be provided in

sufficient detail to permit us to make an informed decision with respect to the requested

exemption. If you assume business only, explain why an Actuarial Opinion is not available

from your ceding insurer(s).

The application (affidavit and attachment) must include a letter of intent and must be

filed no later than

December 1

of the calendar year for which the exemption is to be

claimed.

We may deny the exemption prior to

December 31

of the same year if we deem the exemption

inappropriate.

A certified (by us) copy of the approved exemption must be filed with the annual statement in

all jurisdictions in which you are authorized.

E-ACTOP (Rev. 12/09)

Page 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1