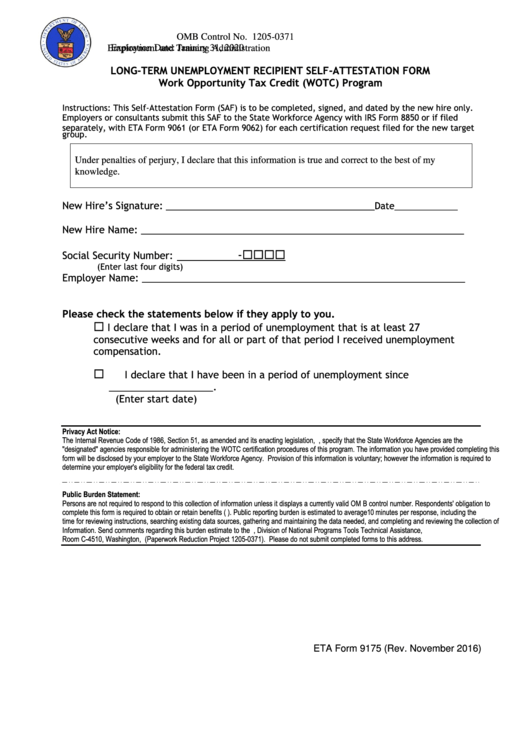

Eta Form 9175 - Long-Term Unemployment Recipient Self-Attestation Form Work Opportunity Tax Credit (Wotc) Program

ADVERTISEMENT

U.S. Department Labor

OMB Control No. 1205-0371

Employment and Training Administration

Expiration Date: January 31, 2020

LONG-TERM UNEMPLOYMENT RECIPIENT SELF-ATTESTATION FORM

Work Opportunity Tax Credit (WOTC) Program

Instructions: This Self-Attestation Form (SAF) is to be completed, signed, and dated by the new hire only.

Employers or consultants submit this SAF to the State Workforce Agency with IRS Form 8850 or if filed

separately, with ETA Form 9061 (or ETA Form 9062) for each certification request filed for the new target

group.

Under penalties of perjury, I declare that this information is true and correct to the best of my

knowledge.

New Hire’s Signature:

__________________________________________Date_____________

New Hire Name: ___________________________________________________________

-

Social Security Number:

(Enter last four digits)

Employer Name: ___________________________________________________________

Please check the statements below if they apply to you.

I declare that I was in a period of unemployment that is at least 27

consecutive weeks and for all or part of that period I received unemployment

compensation.

I declare that I have been in a period of unemployment since

___________________.

(Enter start date)

Privacy Act Notice:

The Internal Revenue Code of 1986, Section 51, as amended and its enacting legislation, P.L. 104-188, specify that the State Workforce Agencies are the

"designated" agencies responsible for administering the WOTC certification procedures of this program. The information you have provided completing this

form will be disclosed by your employer to the State Workforce Agency. Provision of this information is voluntary; however the information is required to

determine your employer's eligibility for the federal tax credit.

Public Burden Statement:

Persons are not required to respond to this collection of information unless it displays a currently valid OM B control number. Respondents' obligation to

complete this form is required to obtain or retain benefits (P.L. 111-5). Public reporting burden is estimated to average 10 minutes per response, including the

time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of

Information. Send comments regarding this burden estimate to the U.S. Department of Labor, Division of National Programs Tools Technical Assistance,

Room C-4510, Washington, D.C. 20210 (Paperwork Reduction Project 1205-0371). Please do not submit completed forms to this address.

ETA Form 9175 (Rev. November 2016)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1