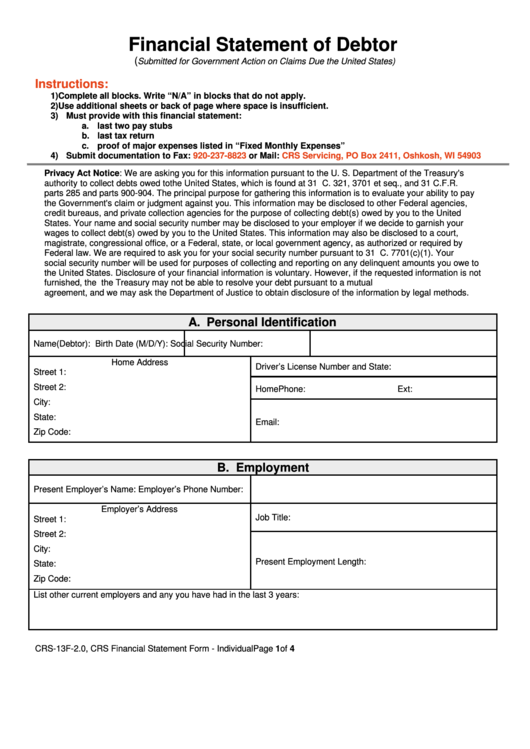

Financial Statement of Debtor

(

Submitted for Government Action on Claims Due the United States)

Instructions:

1) Complete all blocks. Write “N/A” in blocks that do not apply.

2) Use additional sheets or back of page where space is insufficient.

3) Must provide with this financial statement:

a. last two pay stubs

b. last tax return

c. proof of major expenses listed in “Fixed Monthly Expenses”

4) Submit documentation to Fax:

920-237-8823

or Mail:

CRS Servicing, PO Box 2411, Oshkosh, WI 54903

Privacy Act Notice: We are asking you for this information pursuant to the U. S. Department of the Treasury's

authority to collect debts owed to the United States, which is found at 31 U.S.C. 321, 3701 et seq., and 31 C.F.R.

parts 285 and parts 900-904. The principal purpose for gathering this information is to evaluate your ability to pay

the Government's claim or judgment against you. This information may be disclosed to other Federal agencies,

credit bureaus, and private collection agencies for the purpose of collecting debt(s) owed by you to the United

States. Your name and social security number may be disclosed to your employer if we decide to garnish your

wages to collect debt(s) owed by you to the United States. This information may also be disclosed to a court,

magistrate, congressional office, or a Federal, state, or local government agency, as authorized or required by

Federal law. We are required to ask you for your social security number pursuant to 31 U.S.C. 7701(c)(1). Your

social security number will be used for purposes of collecting and reporting on any delinquent amounts you owe to

the United States. Disclosure of your financial information is voluntary. However, if the requested information is not

furnished, the U.S. Department of the Treasury may not be able to resolve your debt pursuant to a mutual

agreement, and we may ask the Department of Justice to obtain disclosure of the information by legal methods.

A. Personal Identification

Name (Debtor):

Birth Date (M/D/Y):

Social Security Number:

Home Address

Driver’s License Number and State:

Street 1:

Street 2:

Home Phone:

Ext:

City:

State:

Email:

Zip Code:

B. Employment

Present Employer’s Name:

Employer’s Phone Number:

Employer’s Address

Job Title:

Street 1:

Street 2:

City:

Present Employment Length:

State:

Zip Code:

List other current employers and any you have had in the last 3 years:

CRS-13F-2.0, CRS Financial Statement Form - Individual

Page 1 of 4

1

1 2

2 3

3 4

4