Ota Form 2 - Petition For Refund - West Virginia Offfice Of Tax Appeals

ADVERTISEMENT

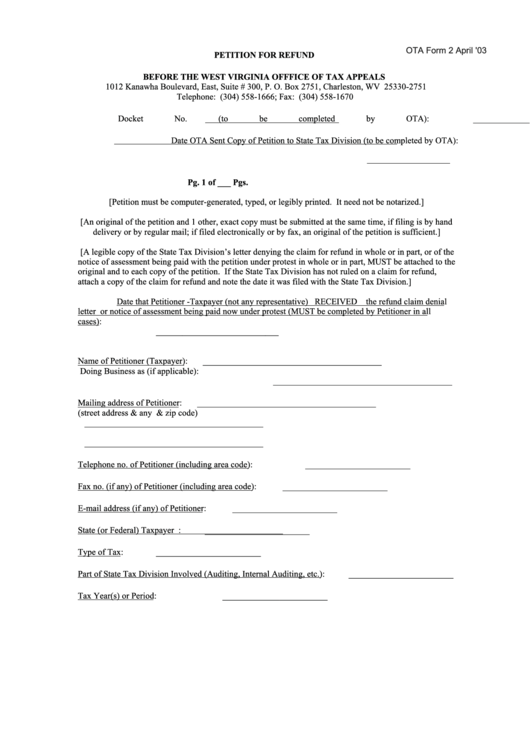

OTA Form 2 April '03

PETITION FOR REFUND

BEFORE THE WEST VIRGINIA OFFFICE OF TAX APPEALS

1012 Kanawha Boulevard, East, Suite # 300, P. O. Box 2751, Charleston, WV 25330-2751

Telephone: (304) 558-1666; Fax: (304) 558-1670

Docket No. (to be completed by OTA):

_______________

Date OTA Sent Copy of Petition to State Tax Division (to be completed by OTA):

___________________

Pg. 1 of ___ Pgs.

[Petition must be computer-generated, typed, or legibly printed. It need not be notarized.]

[An original of the petition and 1 other, exact copy must be submitted at the same time, if filing is by hand

delivery or by regular mail; if filed electronically or by fax, an original of the petition is sufficient.]

[A legible copy of the State Tax Division’s letter denying the claim for refund in whole or in part, or of the

notice of assessment being paid with the petition under protest in whole or in part, MUST be attached to the

original and to each copy of the petition. If the State Tax Division has not ruled on a claim for refund,

attach a copy of the claim for refund and note the date it was filed with the State Tax Division.]

Date that Petitioner -Taxpayer (not any representative) RECEIVED the refund claim denial

letter or notice of assessment being paid now under protest (MUST be completed by Petitioner in all

cases):

____________________________

Name of Petitioner (Taxpayer):

_________________________________________

Doing Business as (if applicable):

_________________________________________

Mailing address of Petitioner:

_________________________________________

(street address & any p.o. box or drawer & zip code)

_________________________________________

_________________________________________

Telephone no. of Petitioner (including area code):

________________________

Fax no. (if any) of Petitioner (including area code):

________________________

E-mail address (if any) of Petitioner:

________________________

State (or Federal) Taxpayer I.D. No. or Social Security No.:

________________________

Type of Tax:

________________________

Part of State Tax Division Involved (Auditing, Internal Auditing, etc.):

________________________

Tax Year(s) or Period:

________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5