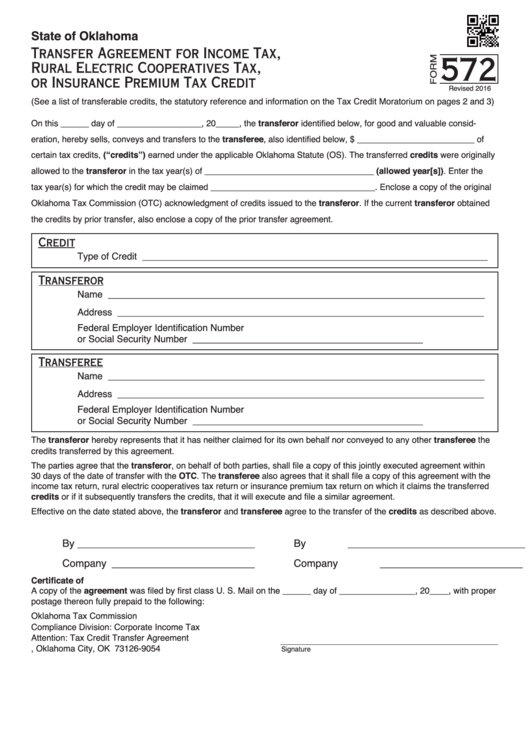

State of Oklahoma

Transfer Agreement for Income Tax,

572

Rural Electric Cooperatives Tax,

or Insurance Premium Tax Credit

Revised 2016

(See a list of transferable credits, the statutory reference and information on the Tax Credit Moratorium on pages 2 and 3)

On this ______ day of __________________, 20_____, the transferor identified below, for good and valuable consid-

eration, hereby sells, conveys and transfers to the transferee, also identified below, $ _________________________ of

certain tax credits, (“credits”) earned under the applicable Oklahoma Statute (OS). The transferred credits were originally

allowed to the transferor in the tax year(s) of ____________________________________ (allowed year[s]). Enter the

tax year(s) for which the credit may be claimed ___________________________________. Enclose a copy of the original

Oklahoma Tax Commission (OTC) acknowledgment of credits issued to the transferor. If the current transferor obtained

the credits by prior transfer, also enclose a copy of the prior transfer agreement.

Credit

Type of Credit __________________________________________________________________

Transferor

Name ________________________________________________________________________

Address ______________________________________________________________________

Federal Employer Identification Number

or Social Security Number

____________________________________________

Transferee

Name ________________________________________________________________________

Address ______________________________________________________________________

Federal Employer Identification Number

or Social Security Number

____________________________________________

The transferor hereby represents that it has neither claimed for its own behalf nor conveyed to any other transferee the

credits transferred by this agreement.

The parties agree that the transferor, on behalf of both parties, shall file a copy of this jointly executed agreement within

30 days of the date of transfer with the OTC. The transferee also agrees that it shall file a copy of this agreement with the

income tax return, rural electric cooperatives tax return or insurance premium tax return on which it claims the transferred

credits or if it subsequently transfers the credits, that it will execute and file a similar agreement.

Effective on the date stated above, the transferor and transferee agree to the transfer of the credits as described above.

Transferor...

Transferee...

By _______________________________

By _______________________________

Company _________________________

Company _________________________

Certificate of Mailing...

A copy of the agreement was filed by first class U. S. Mail on the ______ day of ________________, 20____, with proper

postage thereon fully prepaid to the following:

Oklahoma Tax Commission

Compliance Division: Corporate Income Tax

Attention: Tax Credit Transfer Agreement

P.O. Box 269054, Oklahoma City, OK 73126-9054

Signature

1

1 2

2 3

3