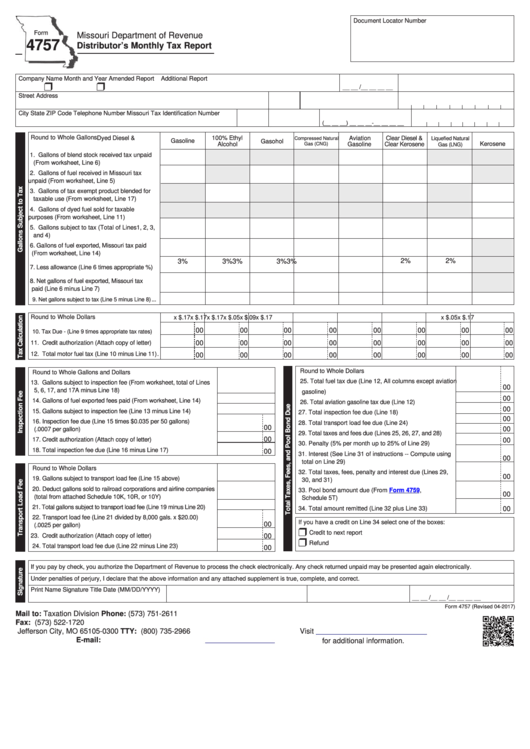

Document Locator Number

Reset Form

Form

Missouri Department of Revenue

4757

Distributor’s Monthly Tax Report

Print Form

Company Name

Month and Year

Amended Report

Additional Report

r

r

__ __ /__ __ __ __

Street Address

P.O. Box

License Number

Federal Identification Number

City

State

ZIP Code

Telephone Number

Missouri Tax Identification Number

(__ __ __) __ __ __-__ __ __ __

Round to Whole Gallons

Dyed Diesel &

100% Ethyl

Aviation

Clear Diesel &

Compressed Natural

Liquefied Natural

Gasoline

Gasohol

Kerosene

Alcohol

Gasoline

Clear Kerosene

Gas (CNG)

Gas (LNG)

1. Gallons of blend stock received tax unpaid

(From worksheet, Line 6) ............................

2. Gallons of fuel received in Missouri tax

unpaid (From worksheet, Line 5)..................

3. Gallons of tax exempt product blended for

taxable use (From worksheet, Line 17) ........

4. Gallons of dyed fuel sold for taxable

purposes (From worksheet, Line 11) ...........

5. Gallons subject to tax (Total of Lines1, 2, 3,

and 4) ...........................................................

6. Gallons of fuel exported, Missouri tax paid

(From worksheet, Line 14) .............................

3%

3%

3%

3%

3%

2%

2%

7. Less allowance (Line 6 times appropriate %)

8. Net gallons of fuel exported, Missouri tax

paid (Line 6 minus Line 7) ..............................

9. Net gallons subject to tax (Line 5 minus Line 8) ...

Round to Whole Dollars

x $.17

x $.17

x $.17

x $.05

x $.09

x $.17

x $.05

x $.17

00

00

00

00

00

00

00

00

10. Tax Due - (Line 9 times appropriate tax rates) ....

11. Credit authorization (Attach copy of letter) ....

00

00

00

00

00

00

00

00

12. Total motor fuel tax (Line 10 minus Line 11) .

00

00

00

00

00

00

00

00

Round to Whole Dollars

Round to Whole Gallons and Dollars

25. Total fuel tax due (Line 12, All columns except aviation

13. Gallons subject to inspection fee (From worksheet, total of Lines

00

5, 6, 17, and 17A minus Line 18) ....................................................

gasoline) ......................................................................

00

14. Gallons of fuel exported fees paid (From worksheet, Line 14) ........

26. Total aviation gasoline tax due (Line 12) .....................

00

15. Gallons subject to inspection fee (Line 13 minus Line 14) ..............

27. Total inspection fee due (Line 18) ..............................

00

16. Inspection fee due (Line 15 times $0.035 per 50 gallons)

28. Total transport load fee due (Line 24) .........................

00

00

(.0007 per gallon) ..............................................................................

29. Total taxes and fees due (Lines 25, 26, 27, and 28) ....

00

17. Credit authorization (Attach copy of letter) .......................................

00

30. Penalty (5% per month up to 25% of Line 29) .............

18. Total inspection fee due (Line 16 minus Line 17) ............................

00

31. Interest (See Line 31 of instructions -- Compute using

00

total on Line 29) ...........................................................

Round to Whole Dollars

32. Total taxes, fees, penalty and interest due (Lines 29,

00

19. Gallons subject to transport load fee (Line 15 above) .....................

30, and 31) ..................................................................

20. Deduct gallons sold to railroad corporations and airline companies

33. Pool bond amount due (From

Form

4759,

00

(total from attached Schedule 10K, 10R, or 10Y) ............................

Schedule 5T) ...............................................................

21. Total gallons subject to transport load fee (Line 19 minus Line 20) ......

34. Total amount remitted (Line 32 plus Line 33) ..............

00

22. Transport load fee (Line 21 divided by 8,000 gals. x $20.00)

If you have a credit on Line 34 select one of the boxes:

00

(.0025 per gallon) ..............................................................................

r

Credit to next report

23. Credit authorization (Attach copy of letter) .......................................

00

r

Refund

24. Total transport load fee due (Line 22 minus Line 23) ......................

00

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Print Name

Signature

Title

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Form 4757 (Revised 04-2017)

Mail to: Taxation Division

Phone: (573) 751-2611

P.O. Box 300

Fax: (573) 522-1720

Jefferson City, MO 65105-0300

TTY: (800) 735-2966

Visit

E-mail:

excise@dor.mo.gov

for additional information.

1

1 2

2 3

3