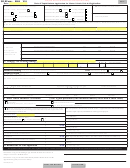

Alcohol Brand Registration Information

In order to market your alcoholic beverage products in the State of South Dakota, they must be first filed and

approved by the United States Department of the Treasury, Alcohol and Tobacco Tax and Trade Bureau.

After federal approval, the following requirements are to be met for label approval in South Dakota.

The following items must be provided by your office if you wish to qualify your company to register and ship

alcoholic beverages into the State of South Dakota:

1. A copy of your product’s Federal Label Approvals

2. A copy of your product’s chemical analysis (if available)

3. Duplicate sets of labels for each brand product registered

4. Application for brand registration approved (done annually)

5. Proper brand registration fee attached to registration application

6. Affidavit from the registered brand owners for brand distribution authority if the brand registration applicant

is not the owner thereof (NOTE: South Dakota requires that wholesalers receive alcoholic beverages only from

the brand owner or his authorized agent.)

7. Copy of invoice of each shipment to our licensed alcoholic beverage wholesalers forwarded on a per shipment

basis to this office

8. Brewers and beer importers must file a monthly report, SPT 110, of all shipments into South Dakota

State liquor taxes are collected by the State at the wholesale level upon receipt by the wholesaler of all imported

alcoholic beverage products.

Any sales person coming into South Dakota to sell your products would be required to obtain an annual

alcoholic beverage solicitors license from this office and all alcoholic beverage products must be sold to and

through one of our in-state licensed alcoholic beverage wholesalers.

1

1 2

2 3

3 4

4