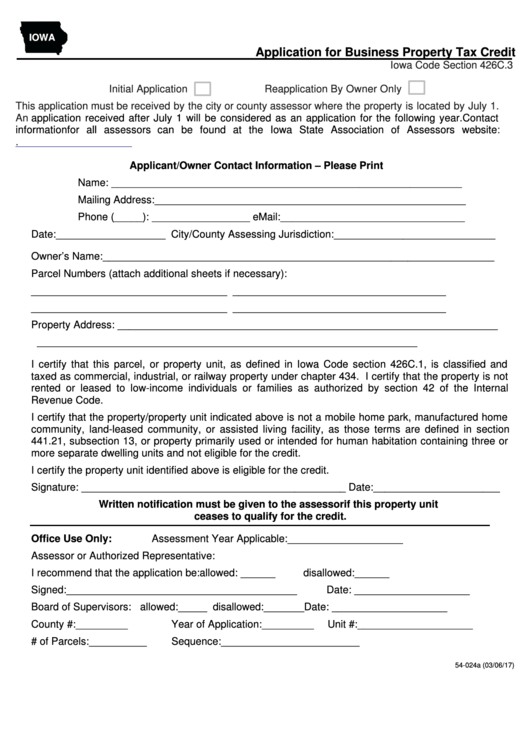

IOWA

Application for Business Property Tax Credit

Iowa Code Section 426C.3

Initial Application

Reapplication By Owner Only

This application must be received by the city or county assessor where the property is located by July 1.

An

application received after July 1 will be considered as an application for the following year. Contact

information for all assessors can be found at the Iowa State Association of Assessors

website:

Applicant/Owner Contact Information – Please Print

Name: _____________________________________________________________

Mailing Address:______________________________________________________

Phone (_____): _________________ eMail:________________________________

Date:___________________ City/County Assessing Jurisdiction:____________________________

Owner’s Name:____________________________________________________________________

Parcel Numbers (attach additional sheets if necessary):

__________________________________

_____________________________________

__________________________________

_____________________________________

Property Address: __________________________________________________________________

__________________________________________________________________

I certify that this parcel, or property unit, as defined in Iowa Code section 426C.1, is classified and

taxed as commercial, industrial, or railway property under chapter 434. I certify that the property is not

rented or leased to low-income individuals or families as authorized by section 42 of the Internal

Revenue Code.

I certify that the property/property unit indicated above is not a mobile home park, manufactured home

community, land-leased community, or assisted living facility, as those terms are defined in section

441.21, subsection 13, or property primarily used or intended for human habitation containing three or

more separate dwelling units and not eligible for the credit.

I certify the property unit identified above is eligible for the credit.

Signature: ______________________________________________ Date:______________________

Written notification must be given to the assessor if this property unit

ceases to qualify for the credit.

Office Use Only:

Assessment Year Applicable:____________________

Assessor or Authorized Representative:

I recommend that the application be: allowed: ______

disallowed:______

Signed:________________________________________

Date: ____________________

Board of Supervisors: allowed:_____ disallowed:_______ Date: ____________________

County #:_________

Year of Application:_________

Unit #:____________________

# of Parcels:__________

Sequence:________________________

54-024a (03/06/17)

1

1 2

2