Form Rpd-41271 - Declaration Of Residency - New Mexico Taxation And Revenue Department

ADVERTISEMENT

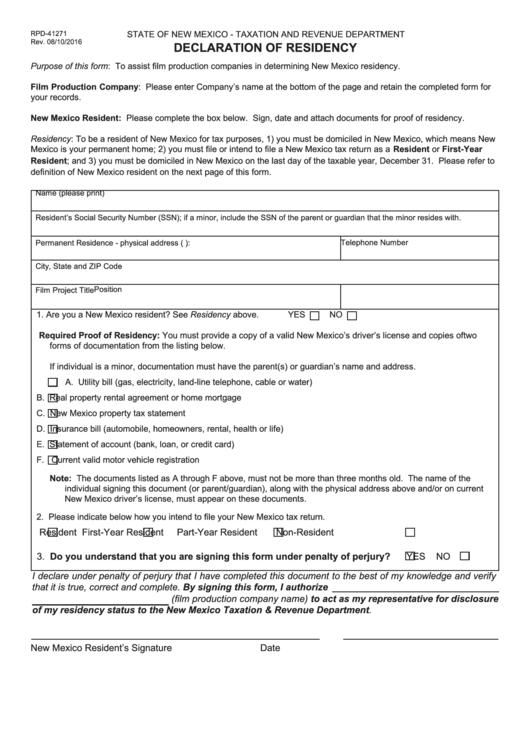

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

RPD-41271

Rev. 08/10/2016

DECLARATION OF RESIDENCY

Purpose of this form: To assist film production companies in determining New Mexico residency.

Film Production Company: Please enter Company’s name at the bottom of the page and retain the completed form for

your records.

New Mexico Resident: Please complete the box below. Sign, date and attach documents for proof of residency.

Residency: To be a resident of New Mexico for tax purposes, 1) you must be domiciled in New Mexico, which means New

Mexico is your permanent home; 2) you must file or intend to file a New Mexico tax return as a Resident or First-Year

Resident; and 3) you must be domiciled in New Mexico on the last day of the taxable year, December 31. Please refer to

definition of New Mexico resident on the next page of this form.

Name (please print)

Resident’s Social Security Number (SSN); if a minor, include the SSN of the parent or guardian that the minor resides with.

Permanent Residence - physical address (P.O. boxes not accepted):

Telephone Number

City, State and ZIP Code

Position

Film Project Title

1. Are you a New Mexico resident? See Residency above.

YES

NO

Required Proof of Residency: You must provide a copy of a valid New Mexico’s driver’s license and copies of two

forms of documentation from the listing below.

If individual is a minor, documentation must have the parent(s) or guardian’s name and address.

A. Utility bill (gas, electricity, land-line telephone, cable or water)

B. Real property rental agreement or home mortgage

C. New Mexico property tax statement

D. Insurance bill (automobile, homeowners, rental, health or life)

E. Statement of account (bank, loan, or credit card)

F. Current valid motor vehicle registration

Note: The documents listed as A through F above, must not be more than three months old. The name of the

individual signing this document (or parent/guardian), along with the physical address above and/or on current

New Mexico driver’s license, must appear on these documents.

2. Please indicate below how you intend to file your New Mexico tax return.

Resident

First-Year Resident

Part-Year Resident

Non-Resident

3. Do you understand that you are signing this form under penalty of perjury?

YES

NO

I declare under penalty of perjury that I have completed this document to the best of my knowledge and verify

that it is true, correct and complete. By signing this form, I authorize

(film production company name) to act as my representative for disclosure

of my residency status to the New Mexico Taxation & Revenue Department.

New Mexico Resident’s Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1