Local Hospitality Tax Reporting And Computation Form - Spartanburg County - 2016

ADVERTISEMENT

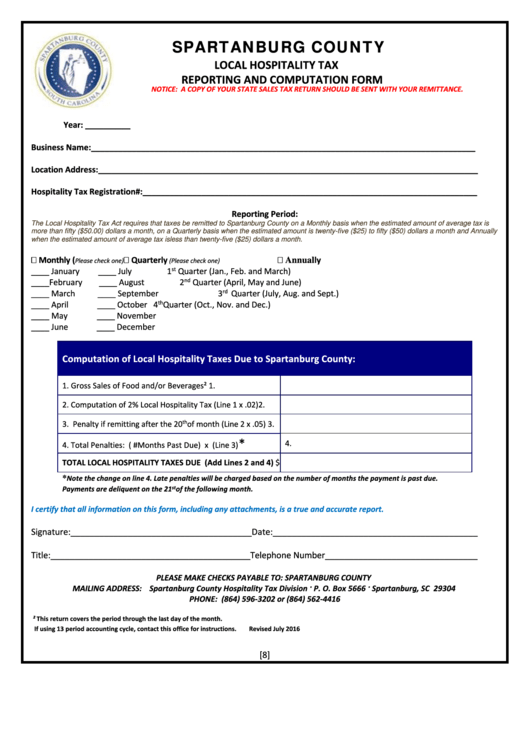

SPARTANBURG COUNTY

LOCAL HOSPITALITY TAX

REPORTING AND COMPUTATION FORM

NOTICE: A COPY OF YOUR STATE SALES TAX RETURN SHOULD BE SENT WITH YOUR REMITTANCE.

Year: __________

Business Name:_____________________________________________________________________________________

Location Address:____________________________________________________________________________________

Hospitality Tax Registration#:__________________________________________________________________________

Reporting Period:

The Local Hospitality Tax Act requires that taxes be remitted to Spartanburg County on a Monthly basis when the estimated amount of average tax is

more than fifty ($50.00) dollars a month, on a Quarterly basis when the estimated amount is twenty-five ($25) to fifty ($50) dollars a month and Annually

when the estimated amount of average tax is less than twenty-five ($25) dollars a month.

Monthly (

Quarterly

Please check one)

(Please check one)

Annually

____ January

____ July

1

st

Quarter (Jan., Feb. and March)

____February

____ August

2

nd

Quarter (April, May and June)

____ March

____ September

3

rd

Quarter (July, Aug. and Sept.)

____ April

____ October

4

th

Quarter (Oct., Nov. and Dec.)

____ May

____ November

____ June

____ December

Computation of Local Hospitality Taxes Due to Spartanburg County:

1. Gross Sales of Food and/or Beverages²

1.

2. Computation of 2% Local Hospitality Tax (Line 1 x .02)

2.

3. Penalty if remitting after the 20

th

of month (Line 2 x .05)

3.

*

4.

4. Total Penalties: ( #Months Past Due) x (Line 3)

TOTAL LOCAL HOSPITALITY TAXES DUE (Add Lines 2 and 4)

$

Note the change on line 4. Late penalties will be charged based on the number of months the payment is past due.

*

Payments are deliquent on the 21

of the following month.

st

I certify that all information on this form, including any attachments, is a true and accurate report.

Signature:______________________________________Date:___________________________________________

Title:__________________________________________Telephone Number________________________________

PLEASE MAKE CHECKS PAYABLE TO: SPARTANBURG COUNTY

MAILING ADDRESS: Spartanburg County Hospitality Tax Division · P. O. Box 5666 · Spartanburg, SC 29304

PHONE: (864) 596-3202 or (864) 562-4416

² This return covers the period through the last day of the month.

If using 13 period accounting cycle, contact this office for instructions.

Revised July 2016

[8]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1