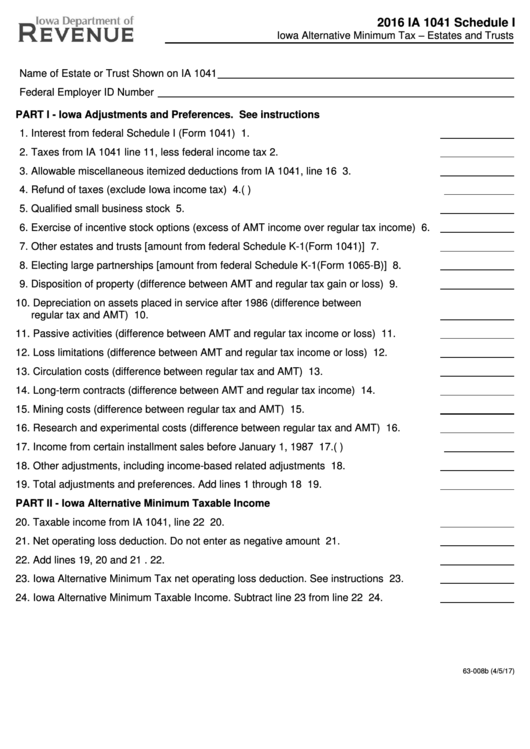

2016 IA 1041 Schedule I

Iowa Alternative Minimum Tax – Estates and Trusts

https://tax.iowa.gov

Name of Estate or Trust Shown on IA 1041

Federal Employer ID Number

PART I - Iowa Adjustments and Preferences. See instructions

1. Interest from federal Schedule I (Form 1041) .................................................................. 1.

2. Taxes from IA 1041 line 11, less federal income tax........................................................ 2.

3. Allowable miscellaneous itemized deductions from IA 1041, line 16 ............................... 3.

4. Refund of taxes (exclude Iowa income tax) ..................................................................... 4.(

)

5. Qualified small business stock ......................................................................................... 5.

6. Exercise of incentive stock options (excess of AMT income over regular tax income) .... 6.

7. Other estates and trusts [amount from federal Schedule K-1(Form 1041)] ...................... 7.

8. Electing large partnerships [amount from federal Schedule K-1(Form 1065-B)] .............. 8.

9. Disposition of property (difference between AMT and regular tax gain or loss) ............... 9.

10. Depreciation on assets placed in service after 1986 (difference between

regular tax and AMT) ..................................................................................................... 10.

11. Passive activities (difference between AMT and regular tax income or loss) ................. 11.

12. Loss limitations (difference between AMT and regular tax income or loss) ................... 12.

13. Circulation costs (difference between regular tax and AMT) .......................................... 13.

14. Long-term contracts (difference between AMT and regular tax income) ........................ 14.

15. Mining costs (difference between regular tax and AMT) ................................................ 15.

16. Research and experimental costs (difference between regular tax and AMT) ............... 16.

17. Income from certain installment sales before January 1, 1987 ...................................... 17.(

)

18. Other adjustments, including income-based related adjustments .................................. 18.

19. Total adjustments and preferences. Add lines 1 through 18 .......................................... 19.

PART II - Iowa Alternative Minimum Taxable Income

20. Taxable income from IA 1041, line 22 ............................................................................ 20.

21. Net operating loss deduction. Do not enter as negative amount .................................... 21.

22. Add lines 19, 20 and 21 ................................................................................................. 22.

23. Iowa Alternative Minimum Tax net operating loss deduction. See instructions .............. 23.

24. Iowa Alternative Minimum Taxable Income. Subtract line 23 from line 22 ..................... 24.

63-008b (4/5/17)

1

1 2

2