Form Rpd-41386 - Technology Jobs And Research And Development Tax Credit Claim Form - 2016

ADVERTISEMENT

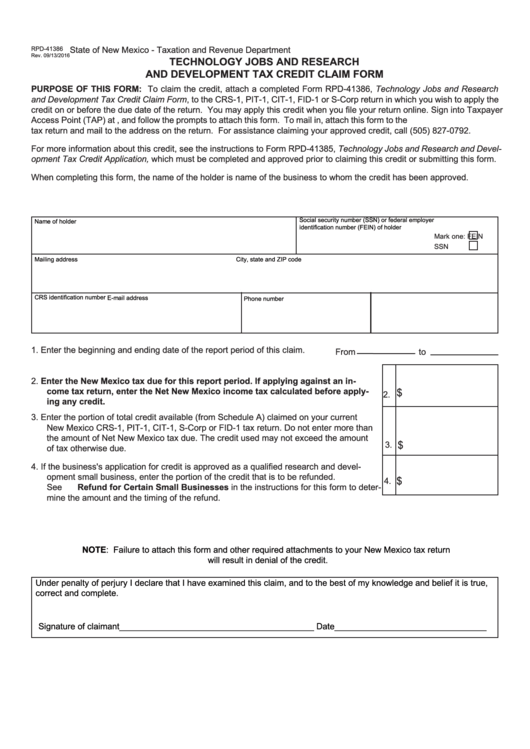

State of New Mexico - Taxation and Revenue Department

RPD-41386

Rev. 09/13/2016

TECHNOLOGY JOBS AND RESEARCH

AND DEVELOPMENT TAX CREDIT CLAIM FORM

PURPOSE OF THIS FORM: To claim the credit, attach a completed Form RPD-41386, Technology Jobs and Research

and Development Tax Credit Claim Form, to the CRS-1, PIT-1, CIT-1, FID-1 or S-Corp return in which you wish to apply the

credit on or before the due date of the return. You may apply this credit when you file your return online. Sign into Taxpayer

Access Point (TAP) at https://tap.state.nm.us, and follow the prompts to attach this form. To mail in, attach this form to the

tax return and mail to the address on the return. For assistance claiming your approved credit, call (505) 827-0792.

For more information about this credit, see the instructions to Form RPD-41385, Technology Jobs and Research and Devel-

opment Tax Credit Application, which must be completed and approved prior to claiming this credit or submitting this form.

When completing this form, the name of the holder is name of the business to whom the credit has been approved.

Social security number (SSN) or federal employer

Name of holder

identification number (FEIN) of holder

Mark one:

FEIN

SSN

Mailing address

City, state and ZIP code

CRS identification number

E-mail address

Phone number

1. Enter the beginning and ending date of the report period of this claim.

From

to

2. Enter the New Mexico tax due for this report period. If applying against an in-

come tax return, enter the Net New Mexico income tax calculated before apply-

$

2.

ing any credit.

3. Enter the portion of total credit available (from Schedule A) claimed on your current

New Mexico CRS-1, PIT-1, CIT-1, S-Corp or FID-1 tax return. Do not enter more than

the amount of Net New Mexico tax due. The credit used may not exceed the amount

$

3.

of tax otherwise due.

4. If the business's application for credit is approved as a qualified research and devel-

opment small business, enter the portion of the credit that is to be refunded.

$

4.

See Refund for Certain Small Businesses in the instructions for this form to deter-

mine the amount and the timing of the refund.

NOTE: Failure to attach this form and other required attachments to your New Mexico tax return

will result in denial of the credit.

Under penalty of perjury I declare that I have examined this claim, and to the best of my knowledge and belief it is true,

correct and complete.

Signature of claimant_________________________________________ Date________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2