Print

Clear

l

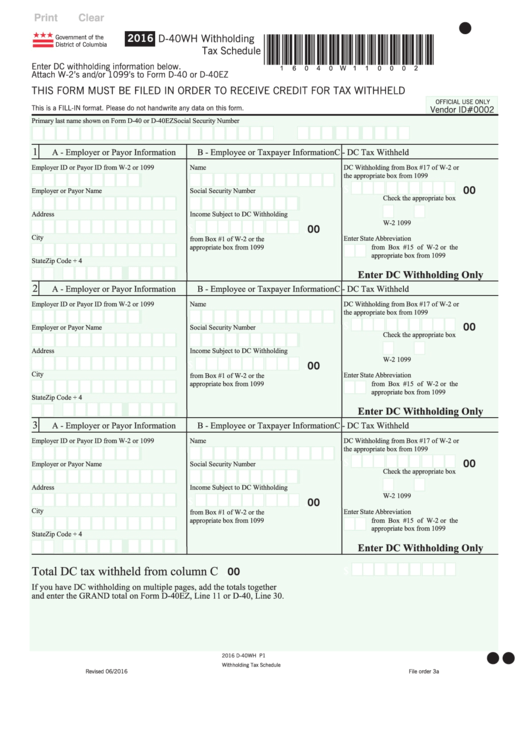

2016

D-40WH Withholding

Government of the

*16040W110002*

District of Columbia

Tax Schedule

Enter DC withholding information below.

Attach W-2’s and/or 1099’s to Form D-40 or D-40EZ

THIS FORM MUST BE FILED IN ORDER TO RECEIVE CREDIT FOR TAX WITHHELD

OFFICIAL USE ONLY

This is a FILL-IN format. Please do not handwrite any data on this form.

Vendor ID#0002

Primary last name shown on Form D-40 or D-40EZ

Social Security Number

1

A - Employer or Payor Information

B - Employee or Taxpayer Information

C - DC Tax Withheld

Employer ID or Payor ID from W-2 or 1099

Name

DC Withholding from Box #17 of W-2 or

the appropriate box from 1099

$

.00

Employer or Payor Name

Social Security Number

Check the appropriate box

Address

Income Subject to DC Withholding

W-2

1099

$

.00

City

Enter State Abbreviation

from Box #1 of W-2 or the

appropriate box from 1099

from Box #15 of W-2 or the

appropriate box from 1099

State

Zip Code + 4

Enter DC Withholding Only

2

A - Employer or Payor Information

B - Employee or Taxpayer Information

C - DC Tax Withheld

Employer ID or Payor ID from W-2 or 1099

Name

DC Withholding from Box #17 of W-2 or

the appropriate box from 1099

$

.00

Employer or Payor Name

Social Security Number

Check the appropriate box

Address

Income Subject to DC Withholding

W-2

1099

$

.00

City

Enter State Abbreviation

from Box #1 of W-2 or the

appropriate box from 1099

from Box #15 of W-2 or the

appropriate box from 1099

State

Zip Code + 4

Enter DC Withholding Only

3

A - Employer or Payor Information

B - Employee or Taxpayer Information

C - DC Tax Withheld

Employer ID or Payor ID from W-2 or 1099

Name

DC Withholding from Box #17 of W-2 or

the appropriate box from 1099

$

.00

Employer or Payor Name

Social Security Number

Check the appropriate box

Address

Income Subject to DC Withholding

W-2

1099

$

.00

City

Enter State Abbreviation

from Box #1 of W-2 or the

from Box #15 of W-2 or the

appropriate box from 1099

appropriate box from 1099

State

Zip Code + 4

Enter DC Withholding Only

Total DC tax withheld from column C above..............................

$

.00

If you have DC withholding on multiple pages, add the totals together

and enter the GRAND total on Form D-40EZ, Line 11 or D-40, Line 30.

l

l

2016 D-40WH P1

Withholding Tax Schedule

Revised 06/2016

File order

3a

1

1 2

2