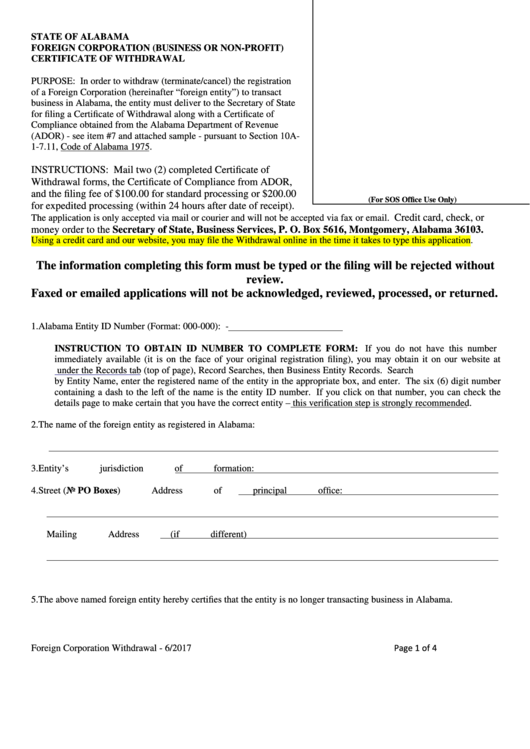

STATE OF ALABAMA

FOREIGN CORPORATION (BUSINESS OR NON-PROFIT)

CERTIFICATE OF WITHDRAWAL

PURPOSE: In order to withdraw (terminate/cancel) the registration

of a Foreign Corporation (hereinafter “foreign entity”) to transact

business in Alabama, the entity must deliver to the Secretary of State

for filing a Certificate of Withdrawal along with a Certificate of

Compliance obtained from the Alabama Department of Revenue

(ADOR) - see item #7 and attached sample - pursuant to Section 10A-

1-7.11, Code of Alabama 1975.

INSTRUCTIONS: Mail two (2) completed Certificate of

Withdrawal forms, the Certificate of Compliance from ADOR,

and the filing fee of $100.00 for standard processing or $200.00

(For SOS Office Use Only)

for expedited processing (within 24 hours after date of receipt).

Credit card, check, or

The application is only accepted via mail or courier and will not be accepted via fax or email.

money order to the Secretary of State, Business Services, P. O. Box 5616, Montgomery, Alabama 36103.

Using a credit card and our website, you may file the Withdrawal online in the time it takes to type this application.

The information completing this form must be typed or the filing will be rejected without

review.

Faxed or emailed applications will not be acknowledged, reviewed, processed, or returned.

1. Alabama Entity ID Number (Format: 000-000):

-

INSTRUCTION TO OBTAIN ID NUMBER TO COMPLETE FORM: If you do not have this number

immediately available (it is on the face of your original registration filing), you may obtain it on our website at

under the Records tab (top of page), Record Searches, then Business Entity Records. Search

by Entity Name, enter the registered name of the entity in the appropriate box, and enter. The six (6) digit number

containing a dash to the left of the name is the entity ID number. If you click on that number, you can check the

details page to make certain that you have the correct entity – this verification step is strongly recommended.

2. The name of the foreign entity as registered in Alabama:

3. Entity’s jurisdiction of formation:

4. Street (No PO Boxes) Address of principal office:

Mailing Address (if different)

5. The above named foreign entity hereby certifies that the entity is no longer transacting business in Alabama.

Page 1 of 4

Foreign Corporation Withdrawal - 6/2017

1

1 2

2 3

3