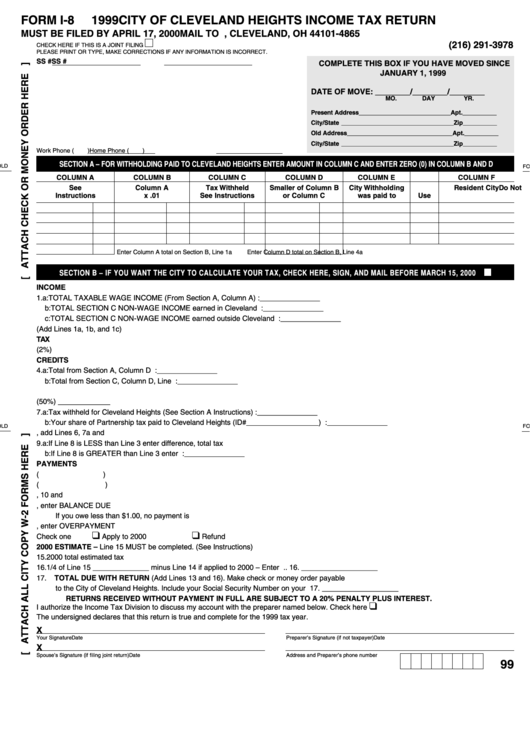

Form I-8 - 1999 City Of Cleveland Heights Income Tax Return

ADVERTISEMENT

FORM I-8

1999

CITY OF CLEVELAND HEIGHTS INCOME TAX RETURN

MUST BE FILED BY APRIL 17, 2000

MAIL TO P.O. BOX 94865, CLEVELAND, OH 44101-4865

(216) 291-3978

CHECK HERE IF THIS IS A JOINT FILING

PLEASE PRINT OR TYPE, MAKE CORRECTIONS IF ANY INFORMATION IS INCORRECT.

SS #

SS #

COMPLETE THIS BOX IF YOU HAVE MOVED SINCE

JANUARY 1, 1999

DATE OF MOVE: ________/________/________

MO.

DAY

YR.

Present Address ___________________________

Apt. __________

City/State _________________________________

Zip

__________

Old Address _______________________________

Apt. __________

City/State _________________________________

Zip

__________

Work Phone (

)

Home Phone (

)

SECTION A – FOR WITHHOLDING PAID TO CLEVELAND HEIGHTS ENTER AMOUNT IN COLUMN C AND ENTER ZERO (0) IN COLUMN B AND D

OLD

FO

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

See

Column A

Tax Withheld

Smaller of Column B

City Withholding

Do Not

Resident City

Instructions

x .01

See Instructions

or Column C

was paid to

Use

Enter Column A total on Section B, Line 1a

Enter Column D total on Section B, Line 4a

SECTION B – IF YOU WANT THE CITY TO CALCULATE YOUR TAX, CHECK HERE, SIGN, AND MAIL BEFORE MARCH 15, 2000

INCOME

1. a: TOTAL TAXABLE WAGE INCOME (From Section A, Column A) .................................. 1.a:

_______________

b: TOTAL SECTION C NON-WAGE INCOME earned in Cleveland Heights ....................... b:

_______________

c: TOTAL SECTION C NON-WAGE INCOME earned outside Cleveland Heights ............... c:

_______________

2.

TOTAL TAXABLE INCOME (Add Lines 1a, 1b, and 1c) ................................................... 2.

_______________

TAX

3.

Multiply Line 2 by .02 (2%) ....................................................................................................................................... 3. ___________________

CREDITS

4. a: Total from Section A, Column D .................................................................................... 4.a:

_______________

b: Total from Section C, Column D, Line 9 ........................................................................... b:

_______________

5.

Add Lines 4a and 4b ........................................................................................................ 5.

_______________

6.

Multiply Line 5 by .50 (50%) ............................................................................................. 6.

_______________

7. a: Tax withheld for Cleveland Heights (See Section A Instructions) .................................. 7.a:

_______________

b: Your share of Partnership tax paid to Cleveland Heights (ID#__________________) .... b:

_______________

OLD

FO

8.

Total Credits, add Lines 6, 7a and 7b ....................................................................................................................... 8. ___________________

9. a: If Line 8 is LESS than Line 3 enter difference, total tax due .................................................................................... 9.a ___________________

b: If Line 8 is GREATER than Line 3 enter difference ....................................................... 9.b:

_______________

PAYMENTS

10.

Prior Year Credits Plus Estimated Payments made as of (

) ............ 10.

_______________

11.

Additional Payments made after (

) ................................................ 11.

_______________

12.

Add Lines 9b, 10 and 11 .......................................................................................................................................... 12. ___________________

13.

If Line 12 is LESS than 9a, enter BALANCE DUE

If you owe less than $1.00, no payment is required ............................................................................................. 13. ___________________

14.

If Line 12 is GREATER than Line 9a, enter OVERPAYMENT .................................................................................. 14. ___________________

❑

❑

Check one

Apply to 2000

Refund

2000 ESTIMATE – Line 15 MUST be completed. (See Instructions)

15.

2000 total estimated tax ................................................................................................. 15.

_______________

16.

1/4 of Line 15 ______________ minus Line 14 if applied to 2000 – Enter difference ............................................. 16. ___________________

17.

TOTAL DUE WITH RETURN (Add Lines 13 and 16). Make check or money order payable

to the City of Cleveland Heights. Include your Social Security Number on your check ............................................ 17. ___________________

RETURNS RECEIVED WITHOUT PAYMENT IN FULL ARE SUBJECT TO A 20% PENALTY PLUS INTEREST.

❑

I authorize the Income Tax Division to discuss my account with the preparer named below. Check here

The undersigned declares that this return is true and complete for the 1999 tax year.

X

Your Signature

Date

Preparer’s Signature (if not taxpayer)

Date

X

Spouse’s Signature (if filing joint return)

Date

Address and Preparer’s phone number

99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2