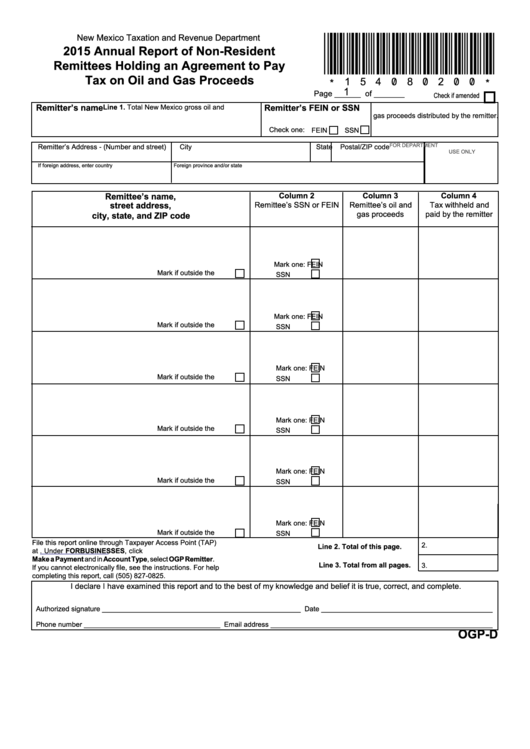

Form Ogp-D - 2015 Annual Report Of Non-Resident Remittees Holding An Agreement To Pay Tax On Oil And Gas Proceeds

ADVERTISEMENT

New Mexico Taxation and Revenue Department

*154080200*

2015 Annual Report of Non-Resident

Remittees Holding an Agreement to Pay

Tax on Oil and Gas Proceeds

1

Page ______ of _______

Check if amended

Remitter’s name

Remitter’s FEIN or SSN

Line 1. Total New Mexico gross oil and

gas proceeds distributed by the remitter.

Check one:

FEIN

SSN

FOR DEPARTMENT

Remitter’s Address - (Number and street)

City

State

Postal/ZIP code

USE ONLY

If foreign address, enter country

Foreign province and/or state

Column 2

Column 3

Column 4

Remittee’s name,

street address,

Remittee’s SSN or FEIN

Remittee’s oil and

Tax withheld and

gas proceeds

paid by the remitter

city, state, and ZIP code

Mark one:

FEIN

Mark if outside the U.S.

SSN

Mark one:

FEIN

Mark if outside the U.S.

SSN

Mark one:

FEIN

Mark if outside the U.S.

SSN

Mark one:

FEIN

Mark if outside the U.S.

SSN

Mark one:

FEIN

Mark if outside the U.S.

SSN

Mark one:

FEIN

Mark if outside the U.S.

SSN

File this report online through Taxpayer Access Point (TAP)

2.

Line 2. Total of this page.

at https://tap.state.nm.us. Under FOR BUSINESSES, click

Make a Payment and in Account Type, select OGP Remitter.

Line 3. Total from all pages.

3.

If you cannot electronically file, see the instructions. For help

completing this report, call (505) 827-0825.

I declare I have examined this report and to the best of my knowledge and belief it is true, correct, and complete.

Authorized signature ___________________________________________________ Date ____________________________________________

Phone number ___________________________________ Email address _________________________________________________________

OGP-D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2