Instructions For Form 100x - Amended Corporation Franchise Or Income Tax Return

ADVERTISEMENT

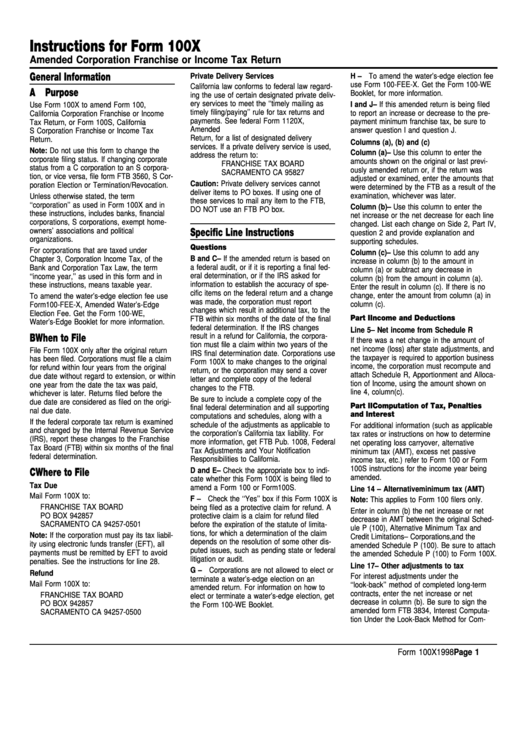

Instructions for Form 100X

Amended Corporation Franchise or Income Tax Return

General Information

Private Delivery Services

H – To amend the water’s-edge election fee

use Form 100-FEE-X. Get the Form 100-WE

California law conforms to federal law regard-

A Purpose

Booklet, for more information.

ing the use of certain designated private deliv-

ery services to meet the ‘‘timely mailing as

I and J – If this amended return is being filed

Use Form 100X to amend Form 100,

timely filing/paying’’ rule for tax returns and

to report an increase or decrease to the pre-

California Corporation Franchise or Income

payments. See federal Form 1120X,

payment minimum franchise tax, be sure to

Tax Return, or Form 100S, California

Amended U.S. Corporation Income Tax

answer question I and question J.

S Corporation Franchise or Income Tax

Return, for a list of designated delivery

Return.

Columns (a), (b) and (c)

services. If a private delivery service is used,

Note: Do not use this form to change the

Column (a) – Use this column to enter the

address the return to:

corporate filing status. If changing corporate

amounts shown on the original or last previ-

FRANCHISE TAX BOARD

status from a C corporation to an S corpora-

ously amended return or, if the return was

SACRAMENTO CA 95827

tion, or vice versa, file form FTB 3560, S Cor-

adjusted or examined, enter the amounts that

Caution: Private delivery services cannot

poration Election or Termination/Revocation.

were determined by the FTB as a result of the

deliver items to PO boxes. If using one of

examination, whichever was later.

Unless otherwise stated, the term

these services to mail any item to the FTB,

‘‘corporation’’ as used in Form 100X and in

Column (b) – Use this column to enter the

DO NOT use an FTB PO box.

these instructions, includes banks, financial

net increase or the net decrease for each line

corporations, S corporations, exempt home-

changed. List each change on Side 2, Part IV,

owners’ associations and political

Specific Line Instructions

question 2 and provide explanation and

organizations.

supporting schedules.

Questions

For corporations that are taxed under

Column (c) – Use this column to add any

B and C – If the amended return is based on

Chapter 3, Corporation Income Tax, of the

increase in column (b) to the amount in

a federal audit, or if it is reporting a final fed-

Bank and Corporation Tax Law, the term

column (a) or subtract any decrease in

eral determination, or if the IRS asked for

‘‘income year,’’ as used in this form and in

column (b) from the amount in column (a).

information to establish the accuracy of spe-

these instructions, means taxable year.

Enter the result in column (c). If there is no

cific items on the federal return and a change

change, enter the amount from column (a) in

To amend the water’s-edge election fee use

was made, the corporation must report

column (c).

Form 100-FEE-X, Amended Water’s-Edge

changes which result in additional tax, to the

Election Fee. Get the Form 100-WE,

Part I

Income and Deductions

FTB within six months of the date of the final

Water’s-Edge Booklet for more information.

federal determination. If the IRS changes

Line 5 – Net income from Schedule R

result in a refund for California, the corpora-

B When to File

If there was a net change in the amount of

tion must file a claim within two years of the

net income (loss) after state adjustments, and

File Form 100X only after the original return

IRS final determination date. Corporations use

the taxpayer is required to apportion business

has been filed. Corporations must file a claim

Form 100X to make changes to the original

income, the corporation must recompute and

for refund within four years from the original

return, or the corporation may send a cover

attach Schedule R, Apportionment and Alloca-

due date without regard to extension, or within

letter and complete copy of the federal

tion of Income, using the amount shown on

one year from the date the tax was paid,

changes to the FTB.

line 4, column (c).

whichever is later. Returns filed before the

Be sure to include a complete copy of the

due date are considered as filed on the origi-

Part II

Computation of Tax, Penalties

final federal determination and all supporting

nal due date.

and Interest

computations and schedules, along with a

If the federal corporate tax return is examined

schedule of the adjustments as applicable to

For additional information (such as applicable

and changed by the Internal Revenue Service

the corporation’s California tax liability. For

tax rates or instructions on how to determine

(IRS), report these changes to the Franchise

more information, get FTB Pub. 1008, Federal

net operating loss carryover, alternative

Tax Board (FTB) within six months of the final

Tax Adjustments and Your Notification

minimum tax (AMT), excess net passive

federal determination.

Responsibilities to California.

income tax, etc.) refer to Form 100 or Form

100S instructions for the income year being

D and E – Check the appropriate box to indi-

C Where to File

amended.

cate whether this Form 100X is being filed to

Tax Due

amend a Form 100 or Form 100S.

Line 14 – Alternative minimum tax (AMT)

Mail Form 100X to:

F – Check the ‘‘Yes’’ box if this Form 100X is

Note: This applies to Form 100 filers only.

FRANCHISE TAX BOARD

being filed as a protective claim for refund. A

Enter in column (b) the net increase or net

PO BOX 942857

protective claim is a claim for refund filed

decrease in AMT between the original Sched-

SACRAMENTO CA 94257-0501

before the expiration of the statute of limita-

ule P (100), Alternative Minimum Tax and

tions, for which a determination of the claim

Note: If the corporation must pay its tax liabil-

Credit Limitations – Corporations, and the

depends on the resolution of some other dis-

ity using electronic funds transfer (EFT), all

amended Schedule P (100). Be sure to attach

puted issues, such as pending state or federal

payments must be remitted by EFT to avoid

the amended Schedule P (100) to Form 100X.

litigation or audit.

penalties. See the instructions for line 28.

Line 17 – Other adjustments to tax

G – Corporations are not allowed to elect or

Refund

For interest adjustments under the

terminate a water’s-edge election on an

Mail Form 100X to:

‘‘look-back’’ method of completed long-term

amended return. For information on how to

contracts, enter the net increase or net

FRANCHISE TAX BOARD

elect or terminate a water’s-edge election, get

decrease in column (b). Be sure to sign the

PO BOX 942857

the Form 100-WE Booklet.

amended form FTB 3834, Interest Computa-

SACRAMENTO CA 94257-0500

tion Under the Look-Back Method for Com-

Form 100X 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2