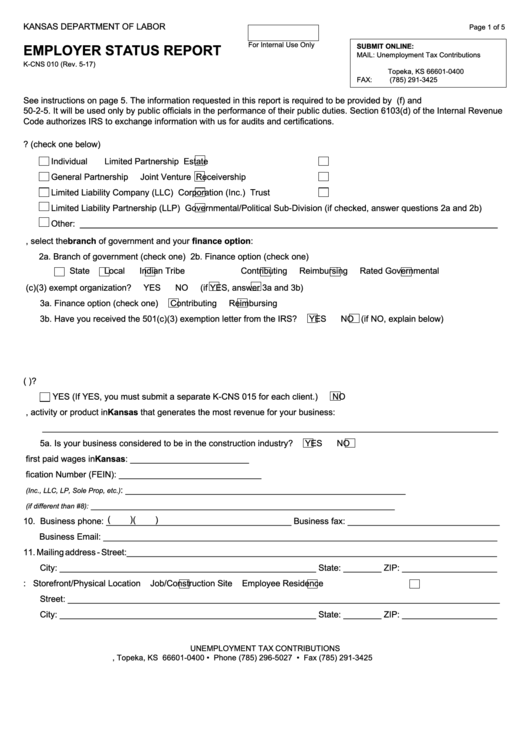

KANSAS DEPARTMENT OF LABOR

Page 1 of 5

For Internal Use Only

EMPLOYER STATUS REPORT

SUBMIT ONLINE:

MAIL:

Unemployment Tax Contributions

P.O. Box 400

K-CNS 010 (Rev. 5-17)

Topeka, KS 66601-0400

FAX:

(785) 291-3425

See instructions on page 5. The information requested in this report is required to be provided by K.S.A. 44-714(f) and K.A.R.

50-2-5. It will be used only by public officials in the performance of their public duties. Section 6103(d) of the Internal Revenue

Code authorizes IRS to exchange information with us for audits and certifications.

1. What is your type of organization / ownership? (check one below)

Individual

Limited Partnership

Estate

General Partnership

Joint Venture

Receivership

Limited Liability Company (LLC)

Corporation (Inc.)

Trust

Limited Liability Partnership (LLP)

Governmental/Political Sub-Division (if checked, answer questions 2a and 2b)

Other: ________________________________________________________________________________________

2. If you are a governmental or political sub-division, select the branch of government and your finance option:

2a. Branch of government (check one)

2b. Finance option (check one)

State

Local

Indian Tribe

Contributing

Reimbursing

Rated Governmental

3. Are you a 501(c)(3) exempt organization?

YES

NO

(if YES, answer 3a and 3b)

3a. Finance option (check one)

Contributing

Reimbursing

3b. Have you received the 501(c)(3) exemption letter from the IRS?

YES

NO (if NO, explain below)

4.

Are you a Professional Employment Organization (P.E.O.)?

YES (If YES, you must submit a separate K-CNS 015 for each client.)

NO

5. Describe the major service, activity or product in Kansas that generates the most revenue for your business:

________________________________________________________________________________________________

5a. Is your business considered to be in the construction industry?

YES

NO

6. Date you first paid wages in Kansas: _________________________

7. List your Federal Employer Identification Number (FEIN): ______________________________

8. Legal business name

: ___________________________________________________________

(Inc., LLC, LP, Sole Prop, etc.)

9. Business or trade name

________________________________________________________________

(if different than #8):

(

)

(

)

10. Business phone: _______________________________________ Business fax: ________________________________

Business Email: ___________________________________________________________________________________

11. Mailing address - Street:______________________________________________________________________________

City: ______________________________________________________ State: ________ ZIP: ____________________

12. Kansas business physical address:

Storefront/Physical Location

Job/Construction Site

Employee Residence

Street: ___________________________________________________________________________________________

City: ______________________________________________________ State: ________ ZIP: ____________________

UNEMPLOYMENT TAX CONTRIBUTIONS

P.O. Box 400, Topeka, KS 66601-0400 • Phone (785) 296-5027 • Fax (785) 291-3425

1

1 2

2 3

3 4

4