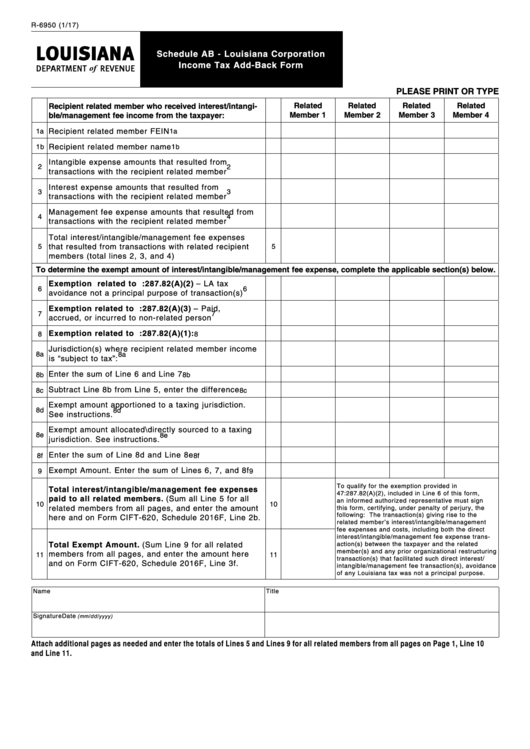

R-6950 (1/17)

Schedule AB - Louisiana Corporation

Income Tax Add-Back Form

PLEASE PRINT OR TYPE

Related

Related

Related

Related

Recipient related member who received interest/intangi-

Member 1

Member 2

Member 3

Member 4

ble/management fee income from the taxpayer:

Recipient related member FEIN

1a

1a

Recipient related member name

1b

1b

Intangible expense amounts that resulted from

2

2

transactions with the recipient related member

Interest expense amounts that resulted from

3

3

transactions with the recipient related member

Management fee expense amounts that resulted from

4

4

transactions with the recipient related member

Total interest/intangible/management fee expenses

that resulted from transactions with related recipient

5

5

members (total lines 2, 3, and 4)

To determine the exempt amount of interest/intangible/management fee expense, complete the applicable section(s) below.

Exemption related to R.S. 47:287.82(A)(2) – LA tax

6

6

avoidance not a principal purpose of transaction(s)

Exemption related to R.S. 47:287.82(A)(3) – Paid,

7

7

accrued, or incurred to non-related person

Exemption related to R.S. 47:287.82(A)(1):

8

8

Jurisdiction(s) where recipient related member income

8a

8a

is “subject to tax”:

Enter the sum of Line 6 and Line 7

8b

8b

Subtract Line 8b from Line 5, enter the difference

8c

8c

Exempt amount apportioned to a taxing jurisdiction.

8d

8d

See instructions.

Exempt amount allocated\directly sourced to a taxing

8e

8e

jurisdiction. See instructions.

Enter the sum of Line 8d and Line 8e

8f

8f

Exempt Amount. Enter the sum of Lines 6, 7, and 8f

9

9

To qualify for the exemption provided in R.S.

Total interest/intangible/management fee expenses

47:287.82(A)(2), included in Line 6 of this form,

paid to all related members. (Sum all Line 5 for all

an informed authorized representative must sign

10

10

related members from all pages, and enter the amount

this form, certifying, under penalty of perjury, the

following: The transaction(s) giving rise to the

here and on Form CIFT-620, Schedule 2016F, Line 2b.

related member’s interest/intangible/management

fee expenses and costs, including both the direct

interest/intangible/management fee expense trans-

Total Exempt Amount. (Sum Line 9 for all related

action(s) between the taxpayer and the related

member(s) and any prior organizational restructuring

members from all pages, and enter the amount here

11

11

transaction(s) that facilitated such direct interest/

and on Form CIFT-620, Schedule 2016F, Line 3f.

intangible/management fee transaction(s), avoidance

of any Louisiana tax was not a principal purpose.

Name

Title

Signature

Date

(mm/dd/yyyy)

Attach additional pages as needed and enter the totals of Lines 5 and Lines 9 for all related members from all pages on Page 1, Line 10

and Line 11.

1

1 2

2 3

3