Form 62a850 - Bank Deposits Tax Return - 2016

ADVERTISEMENT

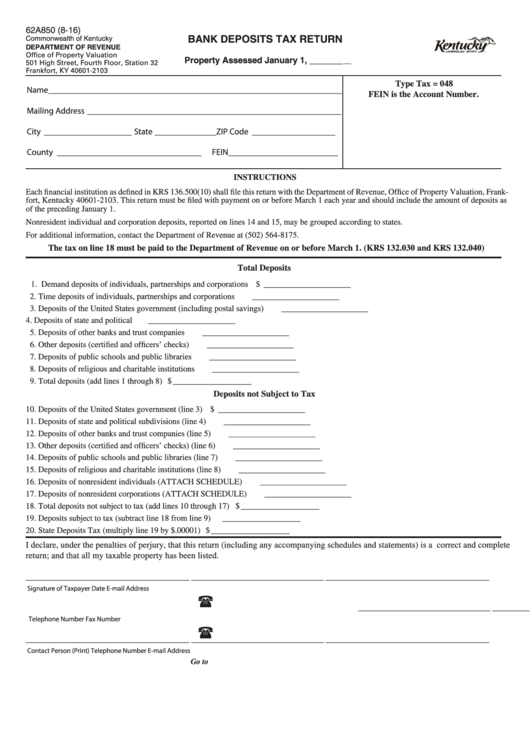

62A850 (8-16)

BANK DEPOSITS TAX RETURN

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Office of Property Valuation

Property Assessed January 1, _______

501 High Street, Fourth Floor, Station 32

Frankfort, KY 40601-2103

Type Tax = 048

Name ___________________________________________________________________

FEIN is the Account Number.

Mailing Address __________________________________________________________

City ____________________ State ______________ ZIP Code ___________________

County _________________________________

FEIN _________________________

INSTRUCTIONS

Each financial institution as defined in KRS 136.500(10) shall file this return with the Department of Revenue, Office of Property Valuation, Frank-

fort, Kentucky 40601-2103. This return must be filed with payment on or before March 1 each year and should include the amount of deposits as

of the preceding January 1.

Nonresident individual and corporation deposits, reported on lines 14 and 15, may be grouped according to states.

For additional information, contact the Department of Revenue at (502) 564-8175.

The tax on line 18 must be paid to the Department of Revenue on or before March 1. (KRS 132.030 and KRS 132.040)

Total Deposits

1. Demand deposits of individuals, partnerships and corporations ............................

$ _____________________

2. Time deposits of individuals, partnerships and corporations .................................

_____________________

3. Deposits of the United States government (including postal savings) ...................

_____________________

4. Deposits of state and political subdivisions............................................................

_____________________

5. Deposits of other banks and trust companies .........................................................

_____________________

6. Other deposits (certified and officers’ checks) .......................................................

_____________________

7. Deposits of public schools and public libraries ......................................................

_____________________

8. Deposits of religious and charitable institutions ....................................................

_____________________

9. Total deposits (add lines 1 through 8) ...................................................................................................................... $ ___________________

Deposits not Subject to Tax

10. Deposits of the United States government (line 3) .................................................

$ _____________________

11. Deposits of state and political subdivisions (line 4) ...............................................

_____________________

12. Deposits of other banks and trust companies (line 5) ............................................

_____________________

13. Other deposits (certified and officers’ checks) (line 6) ...........................................

_____________________

14. Deposits of public schools and public libraries (line 7) .........................................

_____________________

15. Deposits of religious and charitable institutions (line 8) ........................................

_____________________

16. Deposits of nonresident individuals (ATTACH SCHEDULE) ..............................

_____________________

17. Deposits of nonresident corporations (ATTACH SCHEDULE) ............................

_____________________

18. Total deposits not subject to tax (add lines 10 through 17) .................................................................................... $ ___________________

19. Deposits subject to tax (subtract line 18 from line 9)...............................................................................................

___________________

20. State Deposits Tax (multiply line 19 by $.00001) .................................................................................................... $ ___________________

I declare, under the penalties of perjury, that this return (including any accompanying schedules and statements) is a correct and complete

return; and that all my taxable property has been listed.

__________________________________________ __________________________________ __________________________________________

Signature of Taxpayer

Date

E-mail Address

__________________________________ __________________________________________

Telephone Number

Fax Number

__________________________________________ __________________________________ __________________________________________

Contact Person (Print)

Telephone Number

E-mail Address

Go to to download forms.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1