Maryland Form 129 - Request For Copy Of Tax Return

ADVERTISEMENT

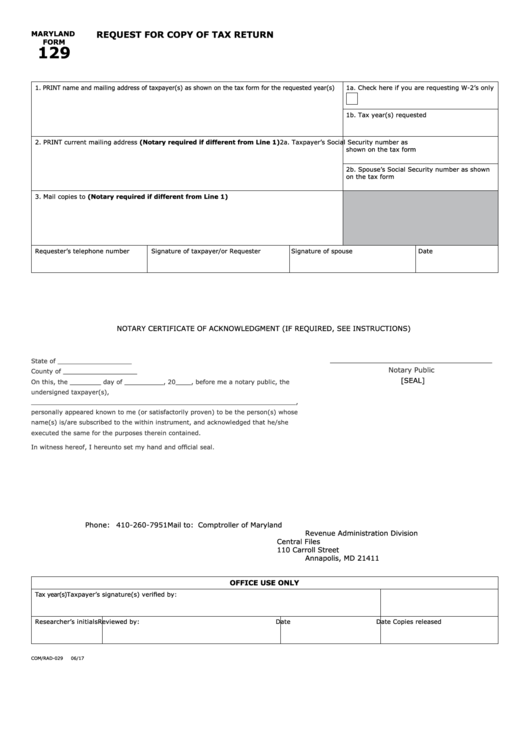

REQUEST FOR COPY OF TAX RETURN

MARYLAND

FORM

129

1. PRINT name and mailing address of taxpayer(s) as shown on the tax form for the requested year(s)

1a. Check here if you are requesting W-2’s only

1b. Tax year(s) requested

2. PRINT current mailing address (Notary required if different from Line 1)

2a. Taxpayer’s Social Security number as

shown on the tax form

2b. Spouse’s Social Security number as shown

on the tax form

3. Mail copies to (Notary required if different from Line 1)

Requester’s telephone number

Signature of taxpayer/or Requester

Signature of spouse

Date

NOTARy CeRTIfICATe Of ACkNOWleDgMeNT (If ReQUIReD, See INSTRUCTIONS)

_____________________________________

State of ___________________

Notary Public

County of ___________________

[SeAl]

On this, the ________ day of __________, 20____, before me a notary public, the

undersigned taxpayer(s),

____________________________________________________________________ ,

personally appeared known to me (or satisfactorily proven) to be the person(s) whose

name(s) is/are subscribed to the within instrument, and acknowledged that he/she

executed the same for the purposes therein contained.

In witness hereof, I hereunto set my hand and official seal.

Phone: 410-260-7951

Mail to: Comptroller of Maryland

Revenue Administration Division

Central Files

110 Carroll Street

Annapolis, MD 21411

OFFICE USE ONLY

Tax year(s)

Taxpayer’s signature(s) verified by:

Researcher’s initials

Reviewed by:

Date

Date Copies released

COM/RAD-029

06/17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1