Reset Form

D5

Rev. 4/17

Tax Release Unit

P.O. Box 182382

Columbus, OH 43218-2382

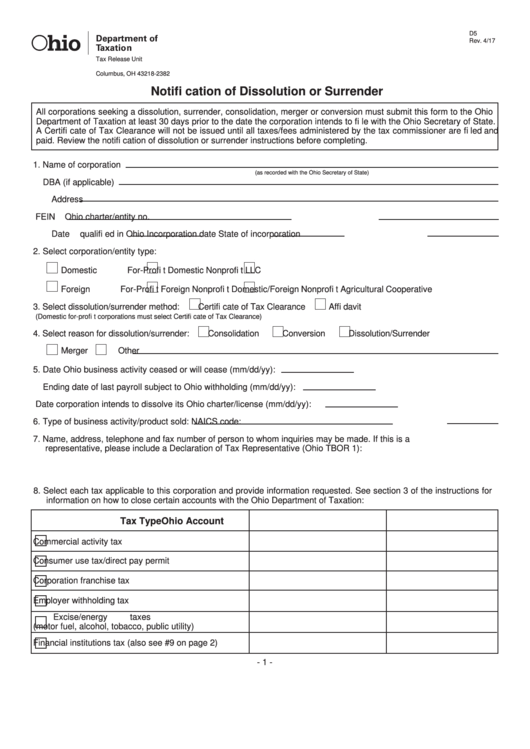

Notifi cation of Dissolution or Surrender

All corporations seeking a dissolution, surrender, consolidation, merger or conversion must submit this form to the Ohio

Department of Taxation at least 30 days prior to the date the corporation intends to fi le with the Ohio Secretary of State.

A Certifi cate of Tax Clearance will not be issued until all taxes/fees administered by the tax commissioner are fi led and

paid. Review the notifi cation of dissolution or surrender instructions before completing.

1. Name of corporation

(as recorded with the Ohio Secretary of State)

DBA (if applicable)

Address

FEIN

Ohio charter/entity no.

Date qualifi ed in Ohio

Incorporation date

State of incorporation

2. Select corporation/entity type:

Domestic For-Profi t

Domestic Nonprofi t

LLC

Foreign For-Profi t

Foreign Nonprofi t

Domestic/Foreign Nonprofi t Agricultural Cooperative

3. Select dissolution/surrender method:

Certifi cate of Tax Clearance

Affi davit

(Domestic for-profi t corporations must select Certifi cate of Tax Clearance)

4. Select reason for dissolution/surrender:

Consolidation

Conversion

Dissolution/Surrender

Merger

Other

5. Date Ohio business activity ceased or will cease (mm/dd/yy):

Ending date of last payroll subject to Ohio withholding (mm/dd/yy):

Date corporation intends to dissolve its Ohio charter/license (mm/dd/yy):

6. Type of business activity/product sold:

NAICS code:

7. Name, address, telephone and fax number of person to whom inquiries may be made. If this is a

representative, please include a Declaration of Tax Representative (Ohio TBOR 1):

8. Select each tax applicable to this corporation and provide information requested. See section 3 of the instructions for

information on how to close certain accounts with the Ohio Department of Taxation:

Tax Type

Ohio Account No.

Date Final Return Filed

Commercial activity tax

Consumer use tax/direct pay permit

Corporation franchise tax

Employer withholding tax

Excise/energy taxes

(motor fuel, alcohol, tobacco, public utility)

Financial institutions tax (also see #9 on page 2)

- 1 -

1

1 2

2