4

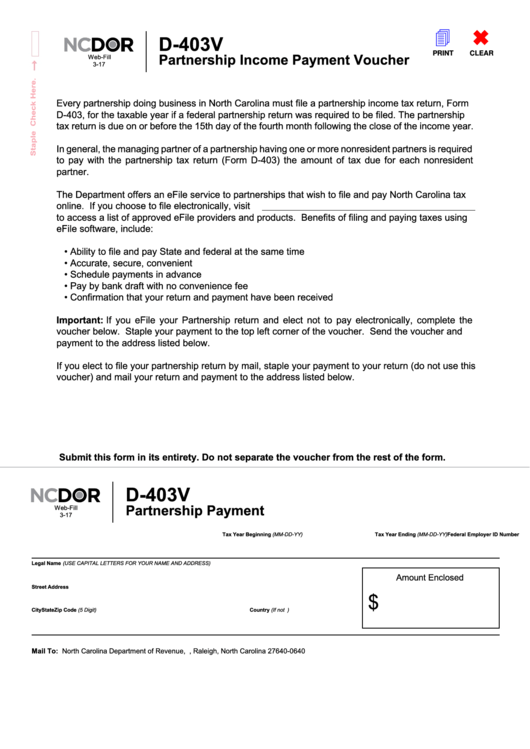

D-403V

Partnership Income Payment Voucher

PRINT

CLEAR

Web-Fill

3-17

Every partnership doing business in North Carolina must file a partnership income tax return, Form

D-403, for the taxable year if a federal partnership return was required to be filed. The partnership

tax return is due on or before the 15th day of the fourth month following the close of the income year.

In general, the managing partner of a partnership having one or more nonresident partners is required

to pay with the partnership tax return (Form D-403) the amount of tax due for each nonresident

partner.

The Department offers an eFile service to partnerships that wish to file and pay North Carolina tax

online. If you choose to file electronically, visit

to access a list of approved eFile providers and products. Benefits of filing and paying taxes using

eFile software, include:

• Ability to file and pay State and federal at the same time

• Accurate, secure, convenient

• Schedule payments in advance

• Pay by bank draft with no convenience fee

• Confirmation that your return and payment have been received

Important: If you eFile your Partnership return and elect not to pay electronically, complete the

voucher below. Staple your payment to the top left corner of the voucher. Send the voucher and

payment to the address listed below.

If you elect to file your partnership return by mail, staple your payment to your return (do not use this

voucher) and mail your return and payment to the address listed below.

Submit this form in its entirety. Do not separate the voucher from the rest of the form.

D-403V

Partnership Payment

Web-Fill

3-17

Federal Employer ID Number

Tax Year Beginning (MM-DD-YY)

Tax Year Ending (MM-DD-YY)

Legal Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Amount Enclosed

Street Address

$

Zip Code (5 Digit)

Country (If not U.S.)

City

State

Mail To: North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0640

1

1