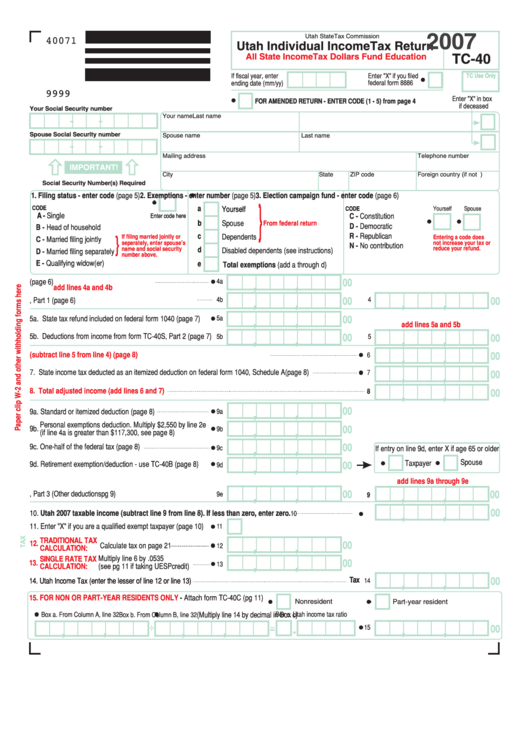

Form Tc-40 - Utah Individual Income Tax Return - 2007

ADVERTISEMENT

2007

Utah State Tax Commission

40071

Utah Individual Income Tax Return

All State Income Tax Dollars Fund Education

TC-40

incometax.utah.gov

If fiscal year, enter

Enter "X" if you filed

TC Use Only

ending date (mm/yy)

federal form 8886

9999

Enter "X" in box

FOR AMENDED RETURN - ENTER CODE (1 - 5) from page 4

if deceased

Your Social Security number

Your name

Last name

-

-

Spouse Social Security number

Spouse name

Last name

-

-

Mailing address

Telephone number

IMPORTANT!

City

State

ZIP code

Foreign country (if not U. S.)

Social Security Number(s) Required

1. Filing status - enter code (page 5)

2. Exemptions - enter number (page 5)

3. Election campaign fund - enter code (page 6)

}

CODE

a

Yourself

CODE

Yourself

Spouse

A - Single

C - Constitution

Enter code here

b

Spouse

From federal return

D - Democratic

B - Head of household

c

R - Republican

Dependents

If filing married jointly or

Entering a code does

}

C - Married filing jointly

separately, enter spouse’s

not increase your tax or

N - No contribution

name and social security

reduce your refund.

d

Disabled dependents (see instructions)

D - Married filing separately

number above.

E - Qualifying widow(er)

e

Total exemptions (add a through d)

4a. Federal adjusted gross income (page 6)

4a

00

,

,

add lines 4a and 4b

4b

00

4

00

4b. Additions to income from form TC-40S, Part 1 (page 6)

,

,

,

,

5a. State tax refund included on federal form 1040 (page 7)

5a

00

,

,

add lines 5a and 5b

5b. Deductions from income from form TC-40S, Part 2 (page 7)

5b

00

5

00

,

,

,

,

6. Modified federal adjusted gross income (subtract line 5 from line 4) (page 8)

6

00

,

,

7. State income tax deducted as an itemized deduction on federal form 1040, Schedule A (page 8)

7

00

,

,

8. Total adjusted income (add lines 6 and 7)

8

00

,

,

00

,

,

9a. Standard or itemized deduction (page 8)

9a

Personal exemptions deduction. Multiply $2,550 by line 2e

9b.

00

,

9b

,

(if line 4a is greater than $117,300, see page 8)

9c. One-half of the federal tax (page 8)

00

,

,

9c

If entry on line 9d, enter X if age 65 or older

Spouse

Taxpayer

9d. Retirement exemption/deduction - use TC-40B (page 8)

00

9d

,

,

add lines 9a through 9e

00

9e.

Other deductions

from income from form TC-40S, Part 3 (

pg 9)

00

9e

,

,

,

,

9

00

,

,

10. Utah 2007 taxable income (subtract line 9 from line 8). If less than zero, enter zero.

10

11. Enter "X" if you are a qualified exempt taxpayer (page 10)

11

TRADITIONAL TAX

12.

00

,

,

Calculate tax on page 21

12

CALCULATION:

Multiply line 6 by .0535

SINGLE RATE TAX

00

13.

,

,

13

(see pg 11 if taking UESP credit)

CALCULATION:

Tax

00

,

14. Utah Income Tax (enter the lesser of line 12 or line 13)

14

,

15. FOR NON OR PART-YEAR RESIDENTS ONLY

- Attach form TC-40C (pg 11)

Nonresident

Part-year resident

Box a. From Column A, line 32

Box c. Utah income tax ratio

(Multiply line 14 by decimal in Box c)

Box b. From Column B, line 32

.

15

00

,

,

,

,

,

,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2