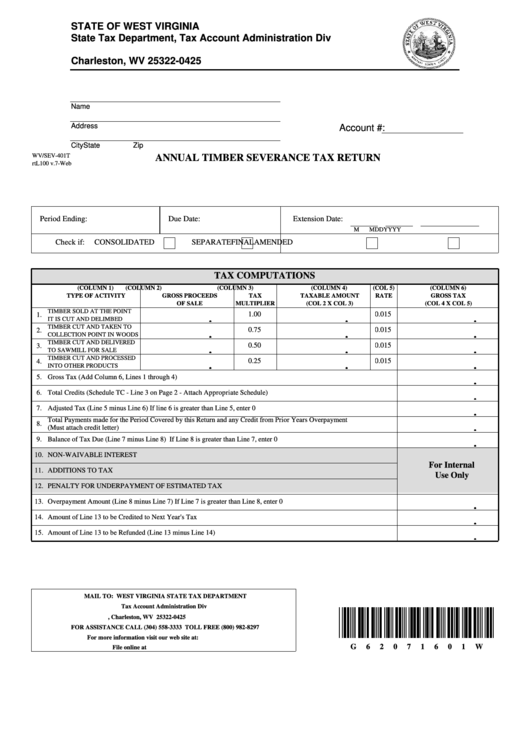

Form Wv/sev-401t - Annual Timber Severance Tax Return

ADVERTISEMENT

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address

Account #:

City

State

Zip

WV/SEV-401T

ANNUAL TIMBER SEVERANCE TAX RETURN

rtL100 v.7-Web

Period Ending:

Due Date:

Extension Date:

M

M

D

D

Y

Y

Y

Y

Check if:

CONSOLIDATED

SEPARATE

FINAL

AMENDED

TAX COMPUTATIONS

(COLUMN 1)

(COLUMN 2)

(COLUMN 3)

(COLUMN 4)

(COL 5)

(COLUMN 6)

TYPE OF ACTIVITY

GROSS PROCEEDS

TAX

TAXABLE AMOUNT

RATE

GROSS TAX

OF SALE

MULTIPLIER

(COL 2 X COL 3)

(COL 4 X COL 5)

TIMBER SOLD AT THE POINT

1.00

0.015

1.

.

.

.

IT IS CUT AND DELIMBED

TIMBER CUT AND TAKEN TO

0.75

0.015

2.

.

.

.

COLLECTION POINT IN WOODS

TIMBER CUT AND DELIVERED

0.50

0.015

3.

.

.

.

TO SAWMILL FOR SALE

TIMBER CUT AND PROCESSED

0.25

0.015

4.

.

.

.

INTO OTHER PRODUCTS

5.

Gross Tax (Add Column 6, Lines 1 through 4)

.

6.

Total Credits (Schedule TC - Line 3 on Page 2 - Attach Appropriate Schedule)

.

7.

Adjusted Tax (Line 5 minus Line 6) If line 6 is greater than Line 5, enter 0

.

Total Payments made for the Period Covered by this Return and any Credit from Prior Years Overpayment

8.

.

(Must attach credit letter)

9.

Balance of Tax Due (Line 7 minus Line 8) If Line 8 is greater than Line 7, enter 0

.

10.

NON-WAIVABLE INTEREST

For Internal

11.

ADDITIONS TO TAX

Use Only

12.

PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

13.

Overpayment Amount (Line 8 minus Line 7) If Line 7 is greater than Line 8, enter 0

.

14.

Amount of Line 13 to be Credited to Next Year's Tax

.

15.

Amount of Line 13 to be Refunded (Line 13 minus Line 14)

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

G

6

2

0

7

1

6

0

1

W

File online at https://mytaxes.wvtax.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2