Form Mo-1040 - Missouri Individual Income Tax Return

ADVERTISEMENT

Page 1

1. Box 3B may be checked only if all of the following apply:(1) you checked Box 3

Form MO-1040

(married filing separate return) on your federal return; (2) your spouse had no

income and is not required to file a federal return; and (3) your spouse qualifies

Missouri Individual

as an exemption on your return and was not a dependent of someone else.

2. Box 6 must be checked if you are claimed as a dependent on another person’ s

Income Tax Return

federal tax return and you checked the “yes” box on Federal Telefile Tax Record,

Line B or Federal Form 1040EZ,Line 5;or you were not allowed to check Box 6a on

Line-by-Line Instructions

Federal Form 1040A or Federal Form 1040.

Only one box may be checked on Lines 1 through 6.

Important:Complete your federal return first.

If you are filing an amended return,please check the box provided at the top left of the

Lines 7–10 — Age 65 or Over and/or Blind

form and complete the entire return using the corrected figures. Also be sure to

If either you or your spouse qualifies for the 65 years of age or blind deduction on your

complete Lines 46,47 and 48.If you are filing a fiscal year return,indicate the beginning

federal return, the appropriate boxes must be checked in addition to one of the boxes

and ending dates on the line provided near the top of the Form MO-1040.

checked on Lines 1 through 6.

100% Disabled Person

Step 1

If you or your spouse is a 100% disabled person, please check the appropriate box.See

definition for 100% disabled.

Name, Address and Social Security Number

Disabled: The inability to engage in any substantial gainful activity by reason of any

If you received a postcard from the Department of Revenue or an income tax instruction

medically determinable physical or mental impairment which can be expected to result

book,please verify that the information on the label is correct.If all addressing informa-

in death or which has lasted or can be expected to last for a continuous period of not

tion is correct, attach the label to Form MO-1040 and print or type your social security

less than twelve months. A claimant shall not be required to be gainfully employed

number(s) in the spaces provided. If you did not receive a postcard or a book with a

prior to such disability to qualify for a property tax credit.

label, or the label is incorrect, print or type your name, address and social security

number(s) in the spaces provided.

Non-Obligated Spouse

Enter your county of residence and the correct number of the public school district in

If you have any other liability due the state of Missouri,your income tax refund may be

which you reside.See school district numbers on page 9 of the instructions.

applied to that liability in accordance with Section 143.781, RSMo. The Internal

Revenue Service (IRS) is not a state agency and the IRS may intercept refunds.If you are

filing a combined return and the state of Missouri is seeking to use your spouse’s state

Step 2

tax refund to offset his/her state liability,you are entitled to receive your portion of the

combined return refund as a non-obligated spouse.Check the appropriate box if you are

Check Your Filing Status

a non-obligated spouse and wish to receive your portion of the refund.

Lines 1–6 — Filing Status and Exemption Amount

The non-obligated spouse refund apportionment applies to state agency debts only.

Check the box applicable to your filing status.You must use the same filing status as on

Since the Internal Revenue Service is not a state agency, Internal Revenue Service

your Federal Form 1040 with two exceptions:

offsets are excluded from the non-obligated spouse refund apportionment. All debtor

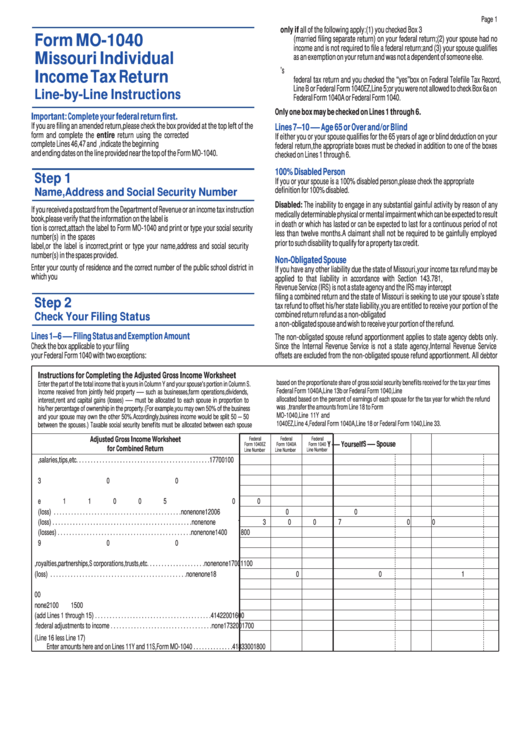

Instructions for Completing the Adjusted Gross Income Worksheet

based on the proportionate share of gross social security benefits received for the tax year times

Enter the part of the total income that is yours in Column Y and your spouse's portion in Column S.

Federal Form 1040A, Line 13b or Federal Form 1040, Line 20b.State income tax refunds must be

Income received from jointly held property — such as businesses, farm operations, dividends,

allocated based on the percent of earnings of each spouse for the tax year for which the refund

interest, rent and capital gains (losses) — must be allocated to each spouse in proportion to

was issued.When you have completed the worksheet,transfer the amounts from Line 18 to Form

his/her percentage of ownership in the property.(For example, you may own 50% of the business

MO-1040, Line 11Y and 11S. The total of Line 18Y and 18S must be equal to Federal Form

and your spouse may own the other 50%. Accordingly, business income would be split 50 – 50

1040EZ, Line 4, Federal Form 1040A, Line 18 or Federal Form 1040, Line 33.

between the spouses.) Taxable social security benefits must be allocated between each spouse

Adjusted Gross Income Worksheet

Federal

Federal

Federal

S — Spouse

Y — Yourself

Form 1040EZ

Form 1040A

Form 1040

for Combined Return

Line Number

Line Number

Line Number

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

7

7

00

1

00

2. Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

8a

8a

00

2

00

3. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

9

9

00

3

00

4. State and local income tax refunds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

10

00

4

00

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

11

00

5

00

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

12

00

6

00

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

13

00

7

00

8. Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

14

00

8

00

9. Taxable IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

10b

15b

00

9

00

10. Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

11b

16b

00

10

00

11. Rents, royalties, partnerships, S corporations, trusts, etc. . . . . . . . . . . . . . . . . . . .

none

none

17

00

11

00

12. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

18

00

12

00

13. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

12

19

00

13

00

14. Taxable social security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

13b

20b

00

14

00

15. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

none

21

00

15

00

16. Total (add Lines 1 through 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

14

22

00

16

00

17. Less: federal adjustments to income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

none

17

32

00

17

00

18. Federal adjusted gross income (Line 16 less Line 17)

Enter amounts here and on Lines 11Y and 11S, Form MO-1040 . . . . . . . . . . . . . .

4

18

33

00

18

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12