Clear

Print

l

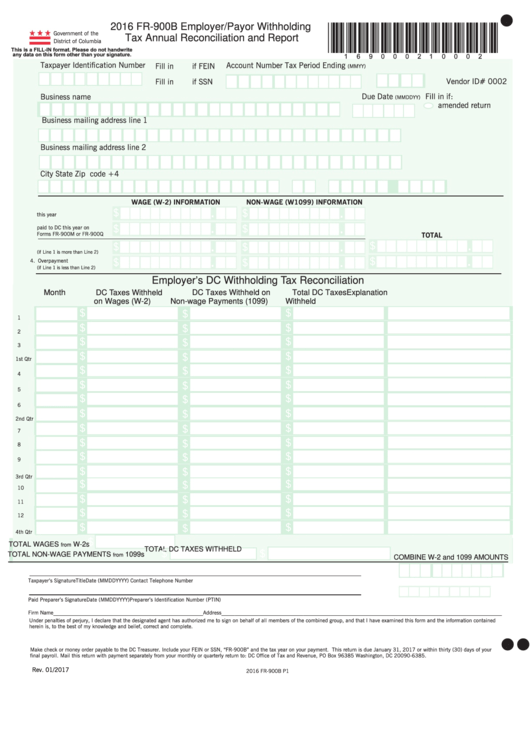

2016 FR-900B Employer/Payor Withholding

*169000210002*

Government of the

Tax Annual Reconciliation and Report

District of Columbia

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

Taxpayer Identification Number

Account Number

Tax Period Ending

Fill in

if FEIN

(MMYY)

Vendor ID# 0002

Fill in

if SSN

Business name

Due Date

Fill in if:

(MMDDYY)

amended return

Business mailing address line 1

Business mailing address line 2

City

State

Zip code +4

WAGE (W-2) INFORMATION

NON-WAGE (W1099) INFORMATION

.

.

1. DC income tax withheld

$

$

this year

2. Total withholding tax

.

.

$

$

paid to DC this year on

Forms FR-900M or FR-900Q

TOTAL

.

.

.

$

$

$

3. Additional Tax Due

(if Line 1 is more than Line 2)

.

.

.

$

$

$

4. Overpayment

(if Line 1 is less than Line 2)

Employer’s DC Withholding Tax Reconciliation

Month

DC Taxes Withheld

DC Taxes Withheld on

Total DC Taxes

Explanation

on Wages (W-2)

Non-wage Payments (1099)

Withheld

$

$

$

1

$

$

$

2

$

$

$

3

$

$

$

1st Qtr

$

$

$

4

$

$

$

5

$

$

$

6

$

$

$

2nd Qtr

$

$

$

7

$

$

$

8

$

$

$

9

$

$

$

3rd Qtr

$

$

$

10

$

$

$

11

$

$

$

12

$

$

$

4th Qtr

$

TOTAL WAGES

W-2s

from

TOTAL DC TAXES WITHHELD

$

$

TOTAL NON-WAGE PAYMENTS

1099s

from

COMBINE W-2 and 1099 AMOUNTS

Taxpayer’s Signature

Title

Date (MMDDYYYY)

Contact Telephone Number

Paid Preparer’s Signature

Date (MMDDYYYY)

Preparer’s Identification Number (PTIN)

Firm Name_______________________________________________________Address_______________________________________________________________________________________________________

Under penalties of perjury, I declare that the designated agent has authorized me to sign on behalf of all members of the combined group, and that I have examined this form and the information contained

herein is, to the best of my knowledge and belief, correct and complete.

l

l

Make check or money order payable to the DC Treasurer. Include your FEIN or SSN, “FR-900B” and the tax year on your payment. This return is due January 31, 2017 or within thirty (30) days of your

final payroll. Mail this return with payment separately from your monthly or quarterly return to: DC Office of Tax and Revenue, PO Box 96385 Washington, DC 20090-6385.

Rev. 01/2017

2016 FR-900B P1

1

1