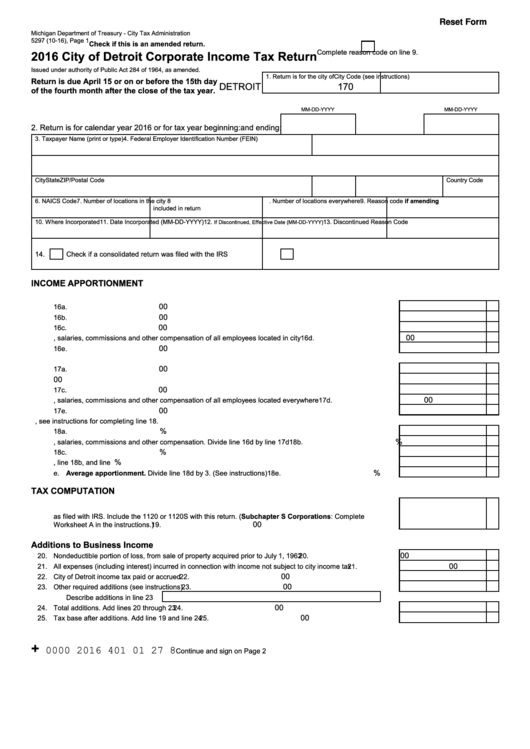

Reset Form

Michigan Department of Treasury - City Tax Administration

5297 (10-16), Page 1

Check if this is an amended return.

Complete reason code on line 9

2016 City of Detroit Corporate Income Tax Return

Issued under authority of Public Act 284 of 1964, as amended

1 Return is for the city of

City Code (see instructions)

Return is due April 15 or on or before the 15th day

DETROIT

170

of the fourth month after the close of the tax year.

MM-DD-YYYY

MM-DD-YYYY

2 Return is for calendar year 2016 or for tax year beginning:

and ending:

3 Taxpayer Name (print or type)

4. Federal Employer Identification Number (FEIN)

5 Street Address

City

State

ZIP/Postal Code

Country Code

6 NAICS Code

7 Number of locations in the city

8

Number of locations everywhere

9 Reason code if amending

included in return

10 Where Incorporated

11 Date Incorporated (MM-DD-YYYY)

12

13 Discontinued Reason Code

If Discontinued, Effective Date (MM-DD-YYYY)

14

Check if a consolidated return was filed with the IRS

15

Check if this is a consolidated return

INCOME APPORTIONMENT

16

For locations in city

00

a Average net book value of real and tangible personal property located in city 16a

00

b Gross annual rent paid for real property located in city multiplied by 8 16b

00

c Add line 16a and line 16b 16c

00

d Total wages, salaries, commissions and other compensation of all employees located in city 16d

00

e Gross receipts from sales made or services rendered in city 16e

17

For locations everywhere

00

a Average net book value of real and tangible personal property located everywhere 17a

00

b Gross annual rent paid for real property located everywhere multiplied by 8 17b

00

c Add line 17a and line 17b 17c

00

d Total wages, salaries, commissions and other compensation of all employees located everywhere 17d

00

e Gross receipts from sales made or services rendered everywhere 17e

18

Apportionment If there are no locations outside the city in line 17, see instructions for completing line 18

%

a Real and tangible personal property Divide line 16c by line 17c 18a

%

b Wages, salaries, commissions and other compensation Divide line 16d by line 17d 18b

%

c Gross receipts from sales Divide line 16e by line 17e 18c

%

d Add line 18a, line 18b, and line 18c 18d

%

e Average apportionment. Divide line 18d by 3 (See instructions) 18e

TAX COMPUTATION

19 Taxable income before net operating loss deduction and special deductions per federal 1120 or 1120S

as filed with IRS. Include the 1120 or 1120S with this return. (Subchapter S Corporations: Complete

00

Worksheet A in the instructions )

19

Additions to Business Income

00

20 Nondeductible portion of loss, from sale of property acquired prior to July 1, 1962

20

00

21 All expenses (including interest) incurred in connection with income not subject to city income tax

21

00

22 City of Detroit income tax paid or accrued

22

00

23 Other required additions (see instructions)

23

Describe additions in line 23

00

24 Total additions Add lines 20 through 23

24

00

25 Tax base after additions Add line 19 and line 24

25

+

0000 2016 401 01 27 8

Continue and sign on Page 2

1

1 2

2