2016 Educational Opportunity Tax Credit - Loan Payment Schedule

ADVERTISEMENT

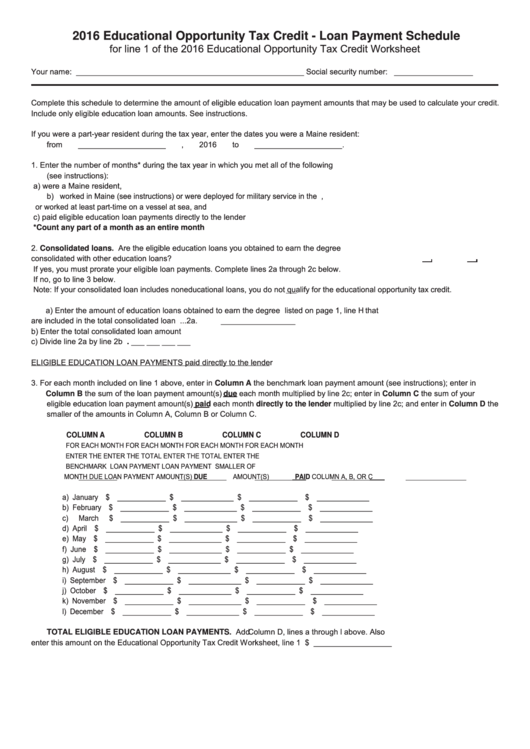

2016 Educational Opportunity Tax Credit - Loan Payment Schedule

for line 1 of the 2016 Educational Opportunity Tax Credit Worksheet

Your name: ____________________________________________________

Social security number: __________________

Complete this schedule to determine the amount of eligible education loan payment amounts that may be used to calculate your credit.

Include only eligible education loan amounts. See instructions.

If you were a part-year resident during the tax year, enter the dates you were a Maine resident:

from ____________________

, 2016

to ____________________ .

1.

Enter the number of months* during the tax year in which you met all of the following

(see instructions): ..................................................................................................................................1.

_________________

a) were a Maine resident,

b) worked in Maine (see instructions) or were deployed for military service in the U.S. Armed Forces,

or worked at least part-time on a vessel at sea, and

c) paid eligible education loan payments directly to the lender

*Count any part of a month as an entire month

2.

Consolidated loans. Are the eligible education loans you obtained to earn the degree

consolidated with other education loans? .............................................................................................. 2.

Yes

No

If yes, you must prorate your eligible loan payments. Complete lines 2a through 2c below.

If no, go to line 3 below.

Note: If your consolidated loan includes noneducational loans, you do not qualify for the educational opportunity tax credit.

a) Enter the amount of education loans obtained to earn the degree listed on page 1, line H that

are included in the total consolidated loan ....................................................................................2a.

_________________

b) Enter the total consolidated loan amount ......................................................................................2b.

_________________

c) Divide line 2a by line 2b ................................................................................................................. 2c.

___ . ___ ___ ___ ___

ELIGIBLE EDUCATION LOAN PAYMENTS paid directly to the lender

3.

For each month included on line 1 above, enter in Column A the benchmark loan payment amount (see instructions); enter in

Column B the sum of the loan payment amount(s) due each month multiplied by line 2c; enter in Column C the sum of your

eligible education loan payment amount(s) paid each month directly to the lender multiplied by line 2c; and enter in Column D the

smaller of the amounts in Column A, Column B or Column C.

COLUMN A

COLUMN B

COLUMN C

COLUMN D

FOR EACH MONTH

FOR EACH MONTH

FOR EACH MONTH

FOR EACH MONTH

ENTER THE

ENTER THE TOTAL

ENTER THE TOTAL

ENTER THE

BENCHMARK

LOAN PAYMENT

LOAN PAYMENT

SMALLER OF

MONTH DUE

LOAN PAYMENT

AMOUNT(S) DUE

AMOUNT(S) PAID

COLUMN A, B, OR C

a)

January .............................

$ ____________

$ _____________

$ ____________

$ _____________

b)

February ...........................

$ ____________

$ _____________

$ ____________

$ _____________

c)

March ................................

$ ____________

$ _____________

$ ____________

$ _____________

d)

April ..................................

$ ____________

$ _____________

$ ____________

$ _____________

e)

May ...................................

$ ____________

$ _____________

$ ____________

$ _____________

f)

June ..................................

$ ____________

$ _____________

$ ____________

$ _____________

g)

July ...................................

$ ____________

$ _____________

$ ____________

$ _____________

h)

August ..............................

$ ____________

$ _____________

$ ____________

$ _____________

i)

September ........................

$ ____________

$ _____________

$ ____________

$ _____________

j)

October .............................

$ ____________

$ _____________

$ ____________

$ _____________

k)

November .........................

$ ____________

$ _____________

$ ____________

$ _____________

l)

December .........................

$ ____________

$ _____________

$ ____________

$ _____________

TOTAL ELIGIBLE EDUCATION LOAN PAYMENTS. Add Column D, lines a through l above. Also

enter this amount on the Educational Opportunity Tax Credit Worksheet, line 1 ................................... 3. $ __________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4