Application Checklist Commercial Real Estate Loan

ADVERTISEMENT

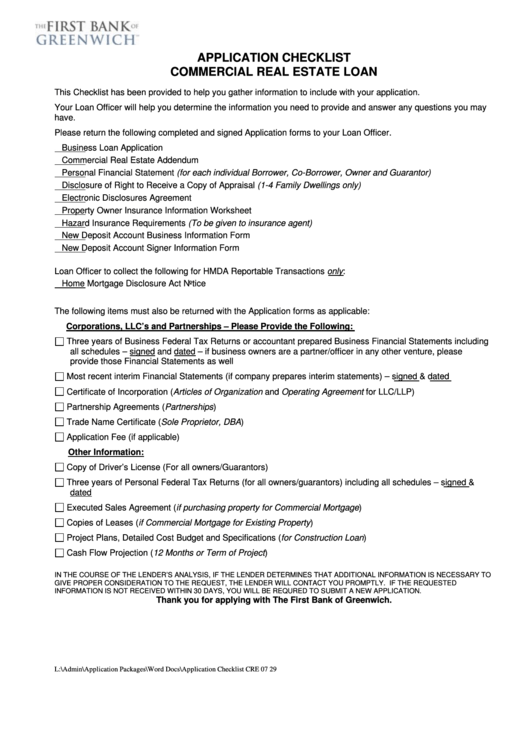

APPLICATION CHECKLIST

COMMERCIAL REAL ESTATE LOAN

This Checklist has been provided to help you gather information to include with your application.

Your Loan Officer will help you determine the information you need to provide and answer any questions you may

have.

Please return the following completed and signed Application forms to your Loan Officer.

Business Loan Application

Commercial Real Estate Addendum

Personal Financial Statement (for each individual Borrower, Co-Borrower, Owner and Guarantor)

Disclosure of Right to Receive a Copy of Appraisal (1-4 Family Dwellings only)

Electronic Disclosures Agreement

Property Owner Insurance Information Worksheet

Hazard Insurance Requirements (To be given to insurance agent)

New Deposit Account Business Information Form

New Deposit Account Signer Information Form

Loan Officer to collect the following for HMDA Reportable Transactions only:

Home Mortgage Disclosure Act Notice

The following items must also be returned with the Application forms as applicable:

Corporations, LLC’s and Partnerships – Please Provide the Following:

Three years of Business Federal Tax Returns or accountant prepared Business Financial Statements including

all schedules – signed and dated – if business owners are a partner/officer in any other venture, please

provide those Financial Statements as well

Most recent interim Financial Statements (if company prepares interim statements) – signed & dated

Certificate of Incorporation (Articles of Organization and Operating Agreement for LLC/LLP)

Partnership Agreements (Partnerships)

Trade Name Certificate (Sole Proprietor, DBA)

Application Fee (if applicable)

Other Information:

Copy of Driver’s License (For all owners/Guarantors)

Three years of Personal Federal Tax Returns (for all owners/guarantors) including all schedules – signed &

dated

Executed Sales Agreement (if purchasing property for Commercial Mortgage)

Copies of Leases (if Commercial Mortgage for Existing Property)

Project Plans, Detailed Cost Budget and Specifications (for Construction Loan)

Cash Flow Projection (12 Months or Term of Project)

IN THE COURSE OF THE LENDER’S ANALYSIS, IF THE LENDER DETERMINES THAT ADDITIONAL INFORMATION IS NECESSARY TO

GIVE PROPER CONSIDERATION TO THE REQUEST, THE LENDER WILL CONTACT YOU PROMPTLY. IF THE REQUESTED

INFORMATION IS NOT RECEIVED WITHIN 30 DAYS, YOU WILL BE REQURED TO SUBMIT A NEW APPLICATION.

Thank you for applying with The First Bank of Greenwich.

L:\Admin\Application Packages\Word Docs\Application Checklist CRE 07 29 15.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25