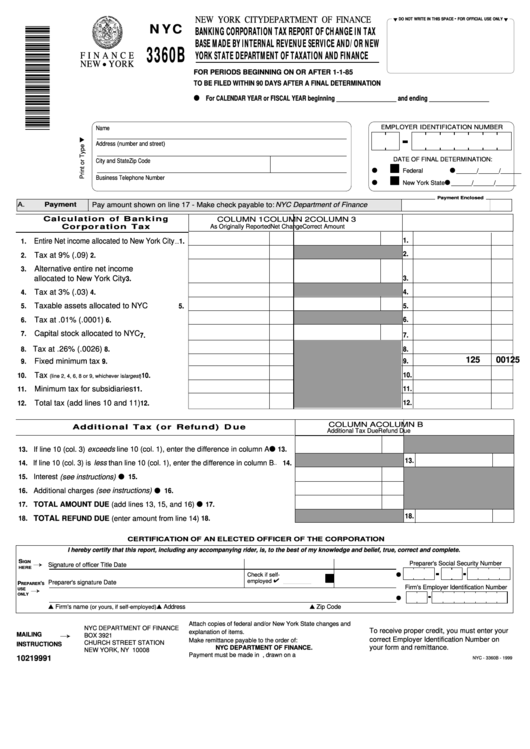

Form Nyc-3360b - Banking Corporation Tax Report Of Change In Tax Base Made By Internal Revenue Service And/or New York State Department Of Taxation And Finance - 1999

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

-

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

N Y C

BANKING CORPORATION TAX REPORT OF CHANGE IN TAX

BASE MADE BY INTERNAL REVENUE SERVICE AND/OR NEW

3360B

YORK STATE DEPARTMENT OF TAXATION AND FINANCE

F I N A N C E

NEW YORK

FOR PERIODS BEGINNING ON OR AFTER 1-1-85

TO BE FILED WITHIN 90 DAYS AFTER A FINAL DETERMINATION

For CALENDAR YEAR or FISCAL YEAR beginning __________________ and ending __________________

EMPLOYER IDENTIFICATION NUMBER

Name

Address (number and street)

DATE OF FINAL DETERMINATION:

City and State

Zip Code

Federal

______/______/______

Business Telephone Number

New York State

______/______/______

Payment Enclosed

Pay amount shown on line 17 - Make check payable to: NYC Department of Finance

A.

Payment

Calculation of Banking

COLUMN 1

COLUMN 2

COLUMN 3

Corporation Tax

As Originally Reported

Net Change

Correct Amount

1.

Entire Net income allocated to New York City

1.

1.

...

2.

2.

Tax at 9% (.09)

2.

.............................................................

3.

Alternative entire net income

allocated to New York City

3.

3.

....................................

Tax at 3% (.03)

4.

4.

4.

.............................................................

Taxable assets allocated to NYC

5.

5.

5.

....................

Tax at .01% (.0001)

6.

6.

6.

...................................................

Capital stock allocated to NYC

7.

7.

7.

...........................

Tax at .26% (.0026)

8.

8.

8.

....................................................

125

00

125

00

9.

Fixed minimum tax

9.

9.

.....................................................

Tax

10.

10.

10.

(line 2, 4, 6, 8 or 9, whichever is largest ) .......................

Minimum tax for subsidiaries

11.

11.

11.

.............................

Total tax (add lines 10 and 11)

12.

12.

12.

........................

COLUMN A

COLUMN B

Additional Tax (or Refund) Due

Additional Tax Due

Refund Due

13.

If line 10 (col. 3) exceeds line 10 (col. 1), enter the difference in column A

13.

13.

14.

If line 10 (col. 3) is less than line 10 (col. 1), enter the difference in column B

14.

..

15.

Interest (see instructions)

15.

...........................................................................................................

16.

Additional charges (see instructions)

16.

..................................................................................

17.

TOTAL AMOUNT DUE (add lines 13, 15, and 16)

17.

...................................................

18.

TOTAL

18.

REFUND DUE (enter amount from line 14)

18.

.....................................................

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this report, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

S

IGN

Preparer's Social Security Number

Signature of officer

Title

Date

HERE

Check if self-

employed

Preparer's signature

Date

P

'

REPARER

S

Firm's Employer Identification Number

USE

ONLY

Firm's name

Address

Zip Code

(or yours, if self-employed)

Attach copies of federal and/or New York State changes and

NYC DEPARTMENT OF FINANCE

To receive proper credit, you must enter your

explanation of items.

MAILING

BOX 3921

correct Employer Identification Number on

Make remittance payable to the order of:

CHURCH STREET STATION

INSTRUCTIONS

your form and remittance.

NYC DEPARTMENT OF FINANCE.

NEW YORK, NY 10008

Payment must be made in U.S. dollars, drawn on a U.S. bank.

10219991

NYC - 3360B - 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1