Form Rpd-41288 - Application For High-Wage Jobs Tax Credit

ADVERTISEMENT

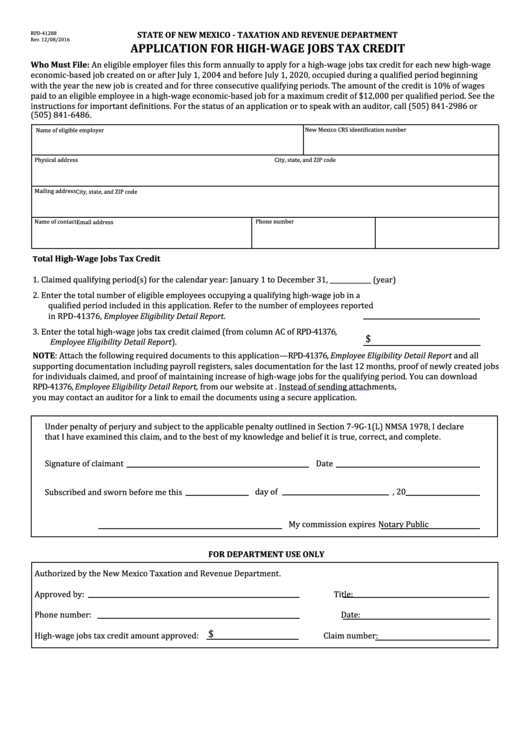

RPD-41288

Rev. 12/08/2016

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

APPLICATION FOR HIGH-WAGE JOBS TAX CREDIT

economic-based job created on or after July 1, 2004 and before July 1, 2020, occupied during a qualified period beginning

Who Must File: An eligible employer files this form annually to apply for a high-wage jobs tax credit for each new high-wage

with the year the new job is created and for three consecutive qualifying periods. The amount of the credit is 10% of wages

paid to an eligible employee in a high-wage economic-based job for a maximum credit of $12,000 per qualified period. See the

instructions for important definitions. For the status of an application or to speak with an auditor, call (505) 841-2986 or

(505) 841-6486.

New Mexico CRS identification number

Name of eligible employer

Physical address

City, state, and ZIP code

Mailing address

City, state, and ZIP code

Name of contact

Phone number

Email address

otal High-Wage Jobs Tax Credit

T

1. Claimed qualifying period(s) for the calendar year: January 1 to December 31, _____________ (year)

2. Enter the total number of eligible employees occupying a qualifying high-wage job in a

qualified period included in this application. Refer to the number of employees reported

in RPD-41376, Employee Eligibility Detail Report.

3. Enter the total high-wage jobs tax credit claimed (from column AC of RPD-41376,

$

NOTE: Attach the following required documents to this application—RPD-41376, Employee Eligibility Detail Report and all

Employee Eligibility Detail Report).

supporting documentation including payroll registers, sales documentation for the last 12 months, proof of newly created jobs

for individuals claimed, and proof of maintaining increase of high-wage jobs for the qualifying period. You can download

RPD-41376, Employee Eligibility Detail Report, from our website at Instead of sending attachments,

you may contact an auditor for a link to email the documents using a secure application.

Under penalty of perjury and subject to the applicable penalty outlined in Section 7-9G-1(L) NMSA 1978, I declare

that I have examined this claim, and to the best of my knowledge and belief it is true, correct, and complete.

Signature of claimant

Date

Subscribed and sworn before me this

day of

, 20

Notary Public

My commission expires

FOR DEPARTMENT USE ONLY

Authorized by the New Mexico Taxation and Revenue Department.

Approved by:

Title:

Phone number:

Date:

$

High-wage jobs tax credit amount approved:

Claim number:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1