Form Rpd-41326 - Rural Health Care Practitioner Tax Credit Claim Form

ADVERTISEMENT

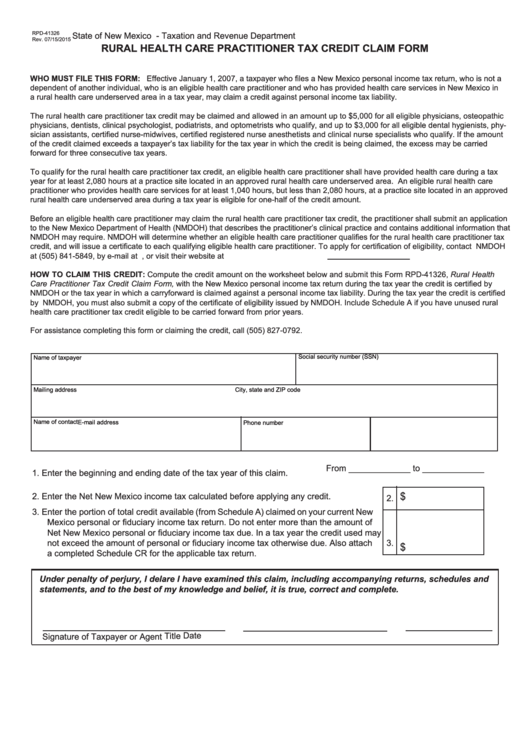

RPD-41326

State of New Mexico - Taxation and Revenue Department

Rev. 07/15/2015

RURAL HEALTH CARE PRACTITIONER TAX CREDIT CLAIM FORM

WHO MUST FILE THIS FORM: Effective January 1, 2007, a taxpayer who files a New Mexico personal income tax return, who is not a

dependent of another individual, who is an eligible health care practitioner and who has provided health care services in New Mexico in

a rural health care underserved area in a tax year, may claim a credit against personal income tax liability.

The rural health care practitioner tax credit may be claimed and allowed in an amount up to $5,000 for all eligible physicians, osteopathic

physicians, dentists, clinical psychologist, podiatrists, and optometrists who qualify, and up to $3,000 for all eligible dental hygienists, phy-

sician assistants, certified nurse-midwives, certified registered nurse anesthetists and clinical nurse specialists who qualify. If the amount

of the credit claimed exceeds a taxpayer’s tax liability for the tax year in which the credit is being claimed, the excess may be carried

forward for three consecutive tax years.

To qualify for the rural health care practitioner tax credit, an eligible health care practitioner shall have provided health care during a tax

year for at least 2,080 hours at a practice site located in an approved rural health care underserved area. An eligible rural health care

practitioner who provides health care services for at least 1,040 hours, but less than 2,080 hours, at a practice site located in an approved

rural health care underserved area during a tax year is eligible for one-half of the credit amount.

Before an eligible health care practitioner may claim the rural health care practitioner tax credit, the practitioner shall submit an application

to the New Mexico Department of Health (NMDOH) that describes the practitioner’s clinical practice and contains additional information that

NMDOH may require. NMDOH will determine whether an eligible health care practitioner qualifies for the rural health care practitioner tax

credit, and will issue a certificate to each qualifying eligible health care practitioner. To apply for certification of eligibility, contact NMDOH

at (505) 841-5849, by e-mail at RHCP.TaxCredit@state.nm.us, or visit their website at

HOW TO CLAIM THIS CREDIT: Compute the credit amount on the worksheet below and submit this Form RPD-41326, Rural Health

Care Practitioner Tax Credit Claim Form, with the New Mexico personal income tax return during the tax year the credit is certified by

NMDOH or the tax year in which a carryforward is claimed against a personal income tax liability. During the tax year the credit is certified

by NMDOH, you must also submit a copy of the certificate of eligibility issued by NMDOH. Include Schedule A if you have unused rural

health care practitioner tax credit eligible to be carried forward from prior years.

For assistance completing this form or claiming the credit, call (505) 827-0792.

Social security number (SSN)

Name of taxpayer

Mailing address

City, state and ZIP code

Name of contact

E-mail address

Phone number

From _____________ to _____________

1. Enter the beginning and ending date of the tax year of this claim.

$

2. Enter the Net New Mexico income tax calculated before applying any credit.

2.

3. Enter the portion of total credit available (from Schedule A) claimed on your current New

Mexico personal or fiduciary income tax return. Do not enter more than the amount of

Net New Mexico personal or fiduciary income tax due. In a tax year the credit used may

3.

not exceed the amount of personal or fiduciary income tax otherwise due. Also attach

$

a completed Schedule CR for the applicable tax return.

Under penalty of perjury, I delare I have examined this claim, including accompanying returns, schedules and

statements, and to the best of my knowledge and belief, it is true, correct and complete.

Date

Title

Signature of Taxpayer or Agent

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2