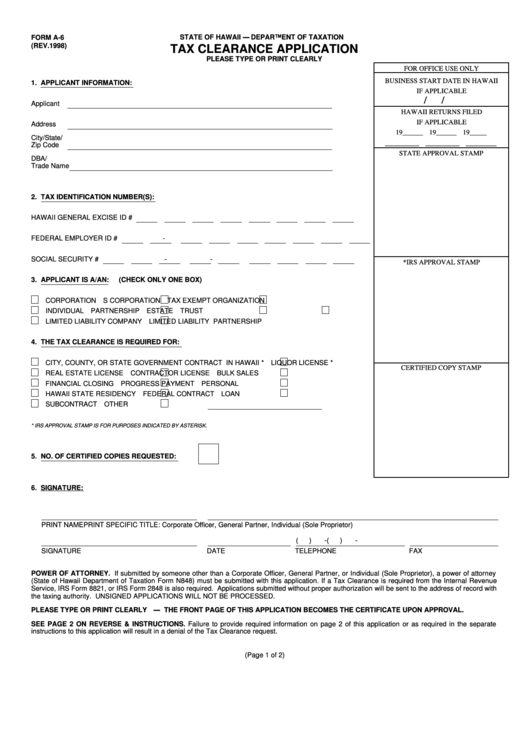

FORM A-6

STATE OF HAWAII ---- DEPARTMENT OF TAXATION

(REV.1998)

TAX CLEARANCE APPLICATION

PLEASE TYPE OR PRINT CLEARLY

FOR OFFICE USE ONLY

BUSINESS START DATE IN HAWAII

1. APPLICANT INFORMATION:

IF APPLICABLE

/

/

Applicant

HAWAII RETURNS FILED

IF APPLICABLE

Address

19______ 19______ 19_____

City/State/

__________ __________ _________

Zip Code

STATE APPROVAL STAMP

DBA/

Trade Name

2. TAX IDENTIFICATION NUMBER(S):

HAWAII GENERAL EXCISE ID #

FEDERAL EMPLOYER ID #

-

SOCIAL SECURITY #

-

-

*IRS APPROVAL STAMP

3. APPLICANT IS A/AN:

(CHECK ONLY ONE BOX)

CORPORATION

S CORPORATION

TAX EXEMPT ORGANIZATION

INDIVIDUAL

PARTNERSHIP

ESTATE

TRUST

LIMITED LIABILITY COMPANY

LIMITED LIABILITY PARTNERSHIP

4. THE TAX CLEARANCE IS REQUIRED FOR:

CITY, COUNTY, OR STATE GOVERNMENT CONTRACT IN HAWAII *

LIQUOR LICENSE *

CERTIFIED COPY STAMP

REAL ESTATE LICENSE

CONTRACTOR LICENSE

BULK SALES

FINANCIAL CLOSING

PROGRESS PAYMENT

PERSONAL

HAWAII STATE RESIDENCY

FEDERAL CONTRACT

LOAN

SUBCONTRACT

OTHER

* IRS APPROVAL STAMP IS FOR PURPOSES INDICATED BY ASTERISK.

5. NO. OF CERTIFIED COPIES REQUESTED:

6. SIGNATURE:

PRINT NAME

PRINT SPECIFIC TITLE: Corporate Officer, General Partner, Individual (Sole Proprietor)

(

)

-

(

)

-

SIGNATURE

DATE

TELEPHONE

FAX

POWER OF ATTORNEY. If submitted by someone other than a Corporate Officer, General Partner, or Individual (Sole Proprietor), a power of attorney

(State of Hawaii Department of Taxation Form N848) must be submitted with this application. If a Tax Clearance is required from the Internal Revenue

Service, IRS Form 8821, or IRS Form 2848 is also required. Applications submitted without proper authorization will be sent to the address of record with

the taxing authority. UNSIGNED APPLICATIONS WILL NOT BE PROCESSED.

PLEASE TYPE OR PRINT CLEARLY ---- THE FRONT PAGE OF THIS APPLICATION BECOMES THE CERTIFICATE UPON APPROVAL.

SEE PAGE 2 ON REVERSE & INSTRUCTIONS. Failure to provide required information on page 2 of this application or as required in the separate

instructions to this application will result in a denial of the Tax Clearance request.

(Page 1 of 2)

1

1 2

2