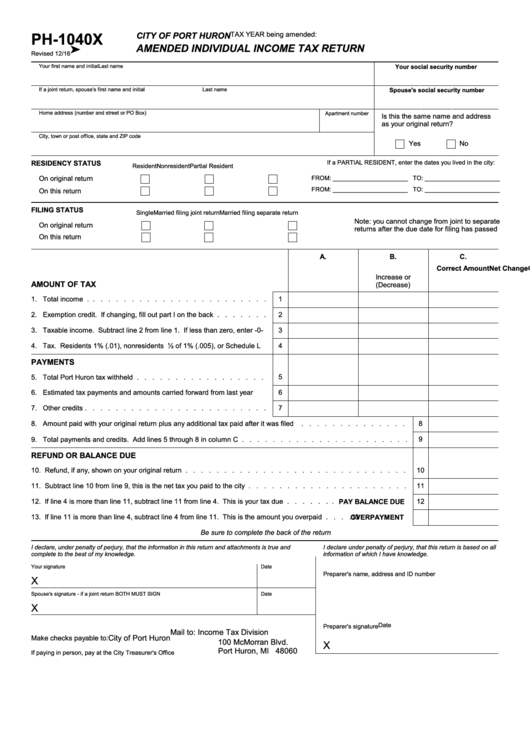

PH-1040X

TAX YEAR being amended:

CITY OF PORT HURON

AMENDED INDIVIDUAL INCOME TAX RETURN

'

Revised 12/16

Your first name and initial

Last name

Your social security number

If a joint return, spouse's first name and initial

Last name

Spouse's social security number

Home address (number and street or PO Box)

Apartment number

Is this the same name and address

as your original return?

City, town or post office, state and ZIP code

Yes

No

RESIDENCY STATUS

If a PARTIAL RESIDENT, enter the dates you lived in the city:

Resident

Nonresident

Partial Resident

On original return

FROM: ______________________ TO: ______________________

FROM: ______________________ TO: ______________________

On this return

FILING STATUS

Single

Married filing joint return

Married filing separate return

Note: you cannot change from joint to separate

On original return

returns after the due date for filing has passed

On this return

A.

B.

C.

On Original Return

Net Change

Correct Amount

Increase or

AMOUNT OF TAX

(Decrease)

1. Total income . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Exemption credit. If changing, fill out part I on the back . . . . . . .

2

3. Taxable income. Subtract line 2 from line 1. If less than zero, enter -0-

3

4. Tax. Residents 1% (.01), nonresidents ½ of 1% (.005), or Schedule L

4

PAYMENTS

5. Total Port Huron tax withheld . . . . . . . . . . . . . . . . .

5

6. Estimated tax payments and amounts carried forward from last year

6

7. Other credits . . . . . . . . . . . . . . . . . . . . . . . .

7

8. Amount paid with your original return plus any additional tax paid after it was filed

. . . . . . . . . . . . . .

8

9. Total payments and credits. Add lines 5 through 8 in column C . . . . . . . . . . . . . . . . . . . . . .

9

REFUND OR BALANCE DUE

10. Refund, if any, shown on your original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11. Subtract line 10 from line 9, this is the net tax you paid to the city . . . . . . . . . . . . . . . . . . . . .

11

12. If line 4 is more than line 11, subtract line 11 from line 4. This is your tax due . . . . . . .

PAY BALANCE DUE

12

13. If line 11 is more than line 4, subtract line 4 from line 11. This is the amount you overpaid . . . .

OVERPAYMENT

13

Be sure to complete the back of the return

I declare, under penalty of perjury, that the information in this return and attachments is true and

I declare under penalty of perjury, that this return is based on all

complete to the best of my knowledge.

information of which I have knowledge.

Your signature

Date

Preparer's name, address and ID number

X

Spouse's signature - if a joint return BOTH MUST SIGN

Date

X

Date

Preparer's signature

Mail to: Income Tax Division

City of Port Huron

Make checks payable to:

100 McMorran Blvd.

X

Port Huron, MI 48060

If paying in person, pay at the City Treasurer's Office

1

1 2

2