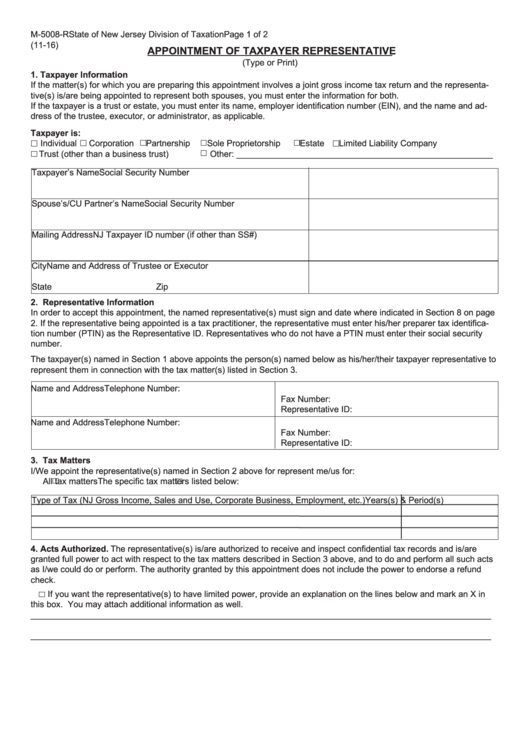

M-5008-R

State of New Jersey Division of Taxation

Page 1 of 2

(11-16)

APPOINTMENT OF TAXPAYER REPRESENTATIVE

(Type or Print)

1. Taxpayer Information

If the matter(s) for which you are preparing this appointment involves a joint gross income tax return and the representa-

tive(s) is/are being appointed to represent both spouses, you must enter the information for both.

If the taxpayer is a trust or estate, you must enter its name, employer identification number (EIN), and the name and ad-

dress of the trustee, executor, or administrator, as applicable.

Taxpayer is:

Individual

Corporation

Partnership

Sole Proprietorship

Estate

Limited Liability Company

Trust (other than a business trust)

Other: ______________________________________________________

Taxpayer’s Name

Social Security Number

Spouse’s/CU Partner’s Name

Social Security Number

Mailing Address

NJ Taxpayer ID number (if other than SS#)

City

Name and Address of Trustee or Executor

State

Zip

2. Representative Information

In order to accept this appointment, the named representative(s) must sign and date where indicated in Section 8 on page

2. If the representative being appointed is a tax practitioner, the representative must enter his/her preparer tax identifica-

tion number (PTIN) as the Representative ID. Representatives who do not have a PTIN must enter their social security

number.

The taxpayer(s) named in Section 1 above appoints the person(s) named below as his/her/their taxpayer representative to

represent them in connection with the tax matter(s) listed in Section 3.

Name and Address

Telephone Number:

Fax Number:

Representative ID:

Name and Address

Telephone Number:

Fax Number:

Representative ID:

3. Tax Matters

I/We appoint the representative(s) named in Section 2 above for represent me/us for:

All tax matters

The specific tax matters listed below:

Type of Tax (NJ Gross Income, Sales and Use, Corporate Business, Employment, etc.)

Years(s) & Period(s)

4. Acts Authorized. The representative(s) is/are authorized to receive and inspect confidential tax records and is/are

granted full power to act with respect to the tax matters described in Section 3 above, and to do and perform all such acts

as I/we could do or perform. The authority granted by this appointment does not include the power to endorse a refund

check.

If you want the representative(s) to have limited power, provide an explanation on the lines below and mark an X in

this box. You may attach additional information as well.

_________________________________________________________________________________________________

_________________________________________________________________________________________________

1

1 2

2