Revised 1998

FORM 512-SA

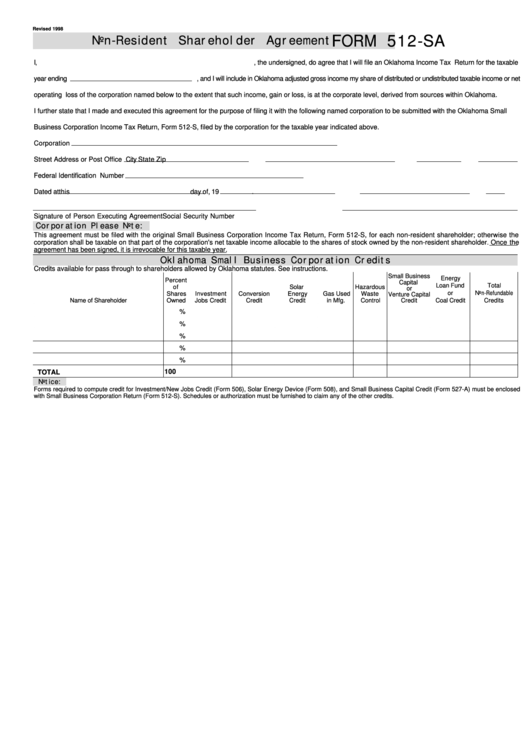

Non-Resident Shareholder Agreement

I,

, the undersigned, do agree that I will file an Oklahoma Income Tax Return for the taxable

year ending

, and I will include in Oklahoma adjusted gross income my share of distributed or undistributed taxable income or net

operating loss of the corporation named below to the extent that such income, gain or loss, is at the corporate level, derived from sources within Oklahoma.

I further state that I made and executed this agreement for the purpose of filing it with the following named corporation to be submitted with the Oklahoma Small

Business Corporation Income Tax Return, Form 512-S, filed by the corporation for the taxable year indicated above.

Corporation

Street Address or Post Office

City

State

Zip

Federal Identification Number

Dated at

this

day of

, 19

.

Signature of Person Executing Agreement

Social Security Number

Corporation Please Note:

This agreement must be filed with the original Small Business Corporation Income Tax Return, Form 512-S, for each non-resident shareholder; otherwise the

corporation shall be taxable on that part of the corporation's net taxable income allocable to the shares of stock owned by the non-resident shareholder. Once the

agreement has been signed, it is irrevocable for this taxable year.

Oklahoma Small Business Corporation Credits

Credits available for pass through to shareholders allowed by Oklahoma statutes. See instructions.

Small Business

Energy

Percent

Capital

Loan Fund

Total

of

C.N.G.

Solar

Hazardous

or

or

Non-Refundable

Shares

Investment

Conversion

Energy

Gas Used

Waste

Venture Capital

Name of Shareholder

Owned

Jobs Credit

Credit

Credit

in Mfg.

Control

Credit

Coal Credit

Credits

%

%

%

%

%

100

TOTAL

Notice:

Forms required to compute credit for Investment/New Jobs Credit (Form 506), Solar Energy Device (Form 508), and Small Business Capital Credit (Form 527-A) must be enclosed

with Small Business Corporation Return (Form 512-S). Schedules or authorization must be furnished to claim any of the other credits.

1

1