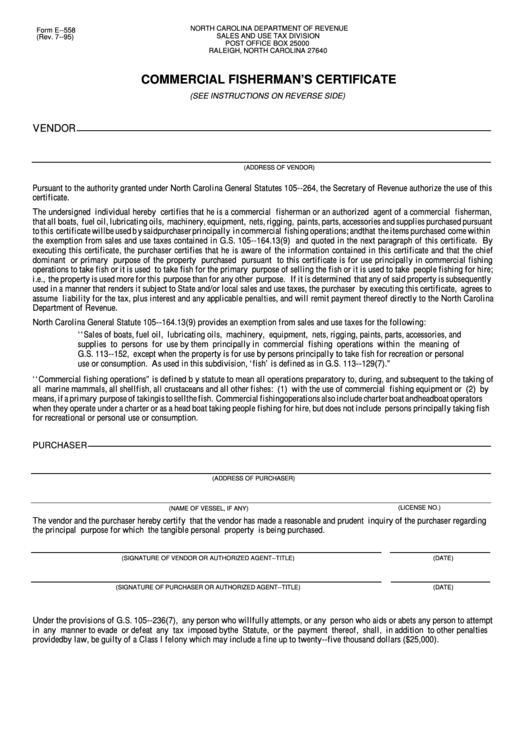

Form E- 558 - Commercial Fisherman'S Certificate - North Carolina Department Of Revenue

ADVERTISEMENT

NORTH CAROLINA DEPARTMENT OF REVENUE

Form E--558

SALES AND USE TAX DIVISION

(Rev. 7--95)

POST OFFICE BOX 25000

RALEIGH, NORTH CAROLINA 27640

COMMERCIAL FISHERMAN’ S CERTIFICATE

(SEE INSTRUCTIONS ON REVERSE SIDE)

VENDOR

(ADDRESS OF VENDOR)

Pursuant to the authority granted under North Carolina General Statutes 105--264, the Secretary of Revenue authorize the use of this

certificate.

The undersigned individual hereby certifies that he is a commercial fisherman or an authorized agent of a commercial fisherman,

that all boats, fuel oil, lubricating oils, machinery, equipment, nets, rigging, paints, parts, accessories and supplies purchased pursuant

to this certificate will be used by said purchaser principally in commercial fishing operations; and that the items purchased come within

the exemption from sales and use taxes contained in G.S. 105--164.13(9) and quoted in the next paragraph of this certificate. By

executing this certificate, the purchaser certifies that he is aware of the information contained in this certificate and that the chief

dominant or primary purpose of the property purchased pursuant to this certificate is for use principally in commercial fishing

operations to take fish or it is used to take fish for the primary purpose of selling the fish or it is used to take people fishing for hire;

i.e., the property is used more for this purpose than for any other purpose. If it is determined that any of said property is subsequently

used in a manner that renders it subject to State and/or local sales and use taxes, the purchaser by executing this certificate, agrees to

assume liability for the tax, plus interest and any applicable penalties, and will remit payment thereof directly to the North Carolina

Department of Revenue.

North Carolina General Statute 105--164.13(9) provides an exemption from sales and use taxes for the following:

‘ ‘ Sales of boats, fuel oil, lubricating oils, machinery, equipment, nets, rigging, paints, parts, accessories, and

supplies to persons for use by them principally in commercial fishing operations within the meaning of

G.S. 113--152, except when the property is for use by persons principally to take fish for recreation or personal

use or consumption. As used in this subdivision, ‘ fish’is defined as in G.S. 113--129(7).”

‘ ‘ Commercial fishing operations” is defined by statute to mean all operations preparatory to, during, and subsequent to the taking of

all marine mammals, all shellfish, all crustaceans and all other fishes: (1) with the use of commercial fishing equipment or (2) by

means, if a primary purpose of taking is to sell the fish. Commercial fishing operations also include charter boat and head boat operators

when they operate under a charter or as a head boat taking people fishing for hire, but does not include persons principally taking fish

for recreational or personal use or consumption.

PURCHASER

(ADDRESS OF PURCHASER)

(LICENSE NO.)

(NAME OF VESSEL, IF ANY)

The vendor and the purchaser hereby certify that the vendor has made a reasonable and prudent inquiry of the purchaser regarding

the principal purpose for which the tangible personal property is being purchased.

(SIGNATURE OF VENDOR OR AUTHORIZED AGENT--TITLE)

(DATE)

(SIGNATURE OF PURCHASER OR AUTHORIZED AGENT--TITLE)

(DATE)

Under the provisions of G.S. 105--236(7), any person who willfully attempts, or any person who aids or abets any person to attempt

in any manner to evade or defeat any tax imposed by the Statute, or the payment thereof, shall, in addition to other penalties

provided by law, be guilty of a Class I felony which may include a fine up to twenty--five thousand dollars ($25,000).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1