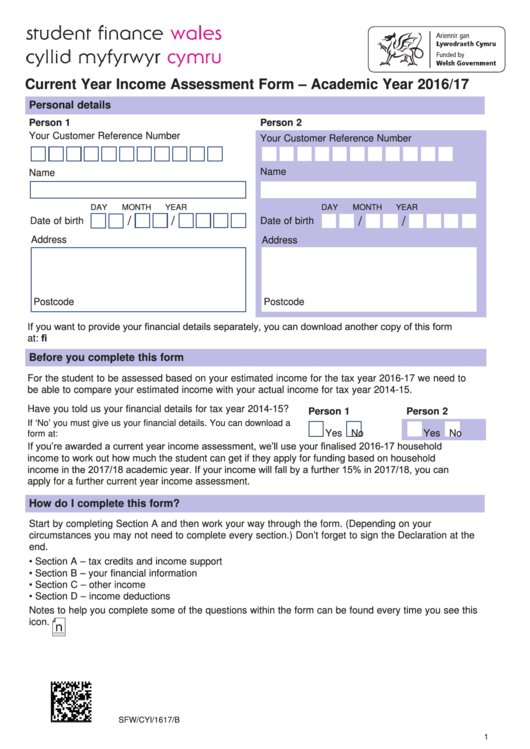

Current Year Income Assessment Form – Academic Year 2016/17

Personal details

Person 1

Person 2

Your Customer Reference Number

Your Customer Reference Number

Name

Name

DAY

MONTH

YEAR

DAY

MONTH

YEAR

/

/

/

/

Date of birth

Date of birth

Address

Address

Postcode

Postcode

If you want to provide your financial details separately, you can download another copy of this form

at:

Before you complete this form

For the student to be assessed based on your estimated income for the tax year 2016-17 we need to

be able to compare your estimated income with your actual income for tax year 2014-15.

Have you told us your financial details for tax year 2014-15?

Person 1

Person 2

If ‘No’ you must give us your financial details. You can download a

Yes

No

Yes

No

form at: /forms

If you’re awarded a current year income assessment, we’ll use your finalised 2016-17 household

income to work out how much the student can get if they apply for funding based on household

income in the 2017/18 academic year. If your income will fall by a further 15% in 2017/18, you can

apply for a further current year income assessment.

How do I complete this form?

Start by completing Section A and then work your way through the form. (Depending on your

circumstances you may not need to complete every section.) Don’t forget to sign the Declaration at the

end.

• Section A – tax credits and income support

• Section B – your financial information

• Section C – other income

• Section D – income deductions

Notes to help you complete some of the questions within the form can be found every time you see this

icon.

SFW/CYI/1617/B

1

1

1 2

2 3

3 4

4 5

5