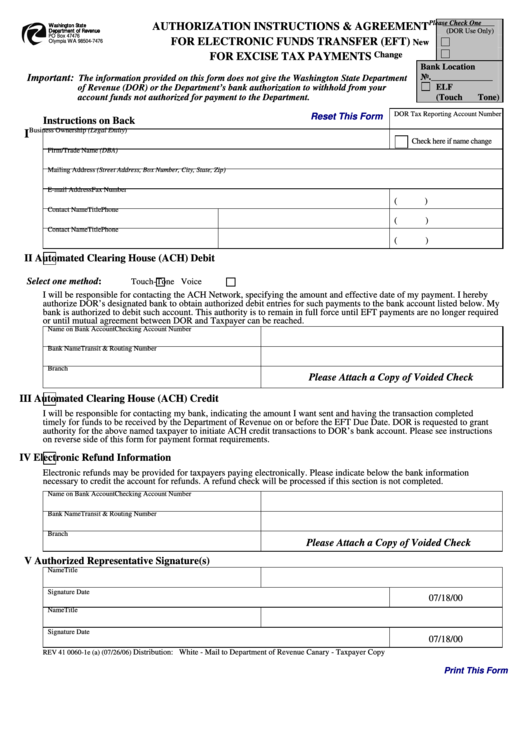

Form 41 0060-1e (A) - Authorization Instructions & Agreement For Electronic Funds Transfer (Eft) For Excise Tax Payments

ADVERTISEMENT

Please Check One

Washington State

AUTHORIZATION INSTRUCTIONS & AGREEMENT

Department of Revenue

(DOR Use Only)

PO Box 47476

FOR ELECTRONIC FUNDS TRANSFER (EFT)

Olympia WA 98504-7476

New

Change

FOR EXCISE TAX PAYMENTS

Bank Location

Important:

No.______________

The information provided on this form does not give the Washington State Department

ELF

of Revenue (DOR) or the Department’s bank authorization to withhold from your

account funds not authorized for payment to the Department.

(Touch Tone)

DOR Tax Reporting Account Number

Reset This Form

Instructions on Back

Business Ownership (Legal Entity)

I

Check here if name change

Firm/Trade Name (DBA)

Mailing Address (Street Address, Box Number, City, State, Zip)

E-mail Address

Fax Number

(

)

Contact Name

Title

Phone

(

)

Contact Name

Title

Phone

(

)

II

Automated Clearing House (ACH) Debit

Select one method:

Touch-Tone

Voice

I will be responsible for contacting the ACH Network, specifying the amount and effective date of my payment. I hereby

authorize DOR’s designated bank to obtain authorized debit entries for such payments to the bank account listed below. My

bank is authorized to debit such account. This authority is to remain in full force until EFT payments are no longer required

or until mutual agreement between DOR and Taxpayer can be reached.

Name on Bank Account

Checking Account Number

Bank Name

Transit & Routing Number

Branch

Please Attach a Copy of Voided Check

III

Automated Clearing House (ACH) Credit

I will be responsible for contacting my bank, indicating the amount I want sent and having the transaction completed

timely for funds to be received by the Department of Revenue on or before the EFT Due Date. DOR is requested to grant

authority for the above named taxpayer to initiate ACH credit transactions to DOR’s bank account. Please see instructions

on reverse side of this form for payment format requirements.

IV

Electronic Refund Information

Electronic refunds may be provided for taxpayers paying electronically. Please indicate below the bank information

necessary to credit the account for refunds. A refund check will be processed if this section is not completed.

Name on Bank Account

Checking Account Number

Bank Name

Transit & Routing Number

Branch

Please Attach a Copy of Voided Check

V

Authorized Representative Signature(s)

Name

Title

Signature

Date

07/18/00

/

/

Name

Title

Signature

Date

07/18/00

/

/

Distribution:

White - Mail to Department of Revenue

Canary - Taxpayer Copy

REV 41 0060-1e (a) (07/26/06)

Print This Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1