(

)

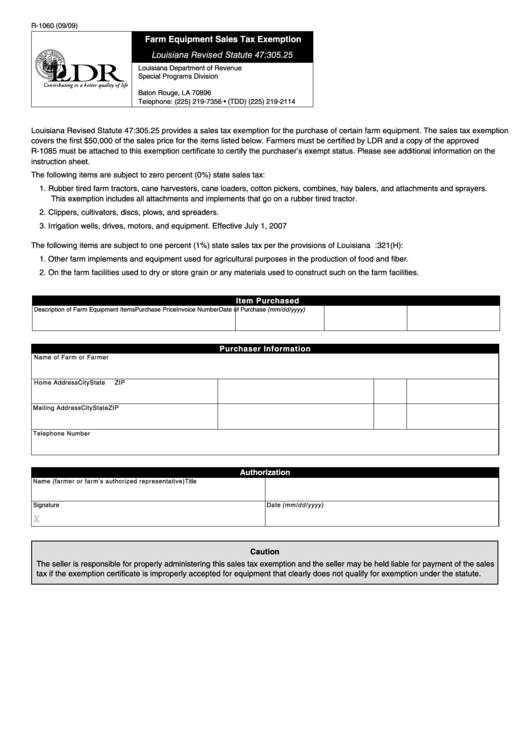

R-1060 (09/09)

Farm Equipment Sales Tax Exemption

Louisiana Revised Statute 47:305.25

Louisiana Department of Revenue

Special Programs Division

P.O. Box 66362

Baton Rouge, LA 70896

Telephone: (225) 219-7356 • (TDD) (225) 219-2114

Louisiana Revised Statute 47:305.25 provides a sales tax exemption for the purchase of certain farm equipment. The sales tax exemption

covers the first $50,000 of the sales price for the items listed below. Farmers must be certified by LDR and a copy of the approved

R-1085 must be attached to this exemption certificate to certify the purchaser’s exempt status. Please see additional information on the

instruction sheet.

The following items are subject to zero percent (0%) state sales tax:

1. Rubber tired farm tractors, cane harvesters, cane loaders, cotton pickers, combines, hay balers, and attachments and sprayers.

This exemption includes all attachments and implements that go on a rubber tired tractor.

2. Clippers, cultivators, discs, plows, and spreaders.

3. Irrigation wells, drives, motors, and equipment. Effective July 1, 2007

The following items are subject to one percent (1%) state sales tax per the provisions of Louisiana R.S. 47:321(H):

1. Other farm implements and equipment used for agricultural purposes in the production of food and fiber.

2. On the farm facilities used to dry or store grain or any materials used to construct such on the farm facilities.

Item Purchased

Description of Farm Equipment Items

Purchase Price

Invoice Number

Date of Purchase (mm/dd/yyyy)

Purchaser Information

Name of Farm or Farmer

Home Address

City

State

ZIP

Mailing Address

City

State

ZIP

Telephone Number

Authorization

Name (farmer or farm’s authorized representative)

Title

Signature

Date (mm/dd/yyyy)

X

Caution

The seller is responsible for properly administering this sales tax exemption and the seller may be held liable for payment of the sales

tax if the exemption certificate is improperly accepted for equipment that clearly does not qualify for exemption under the statute.

1

1 2

2