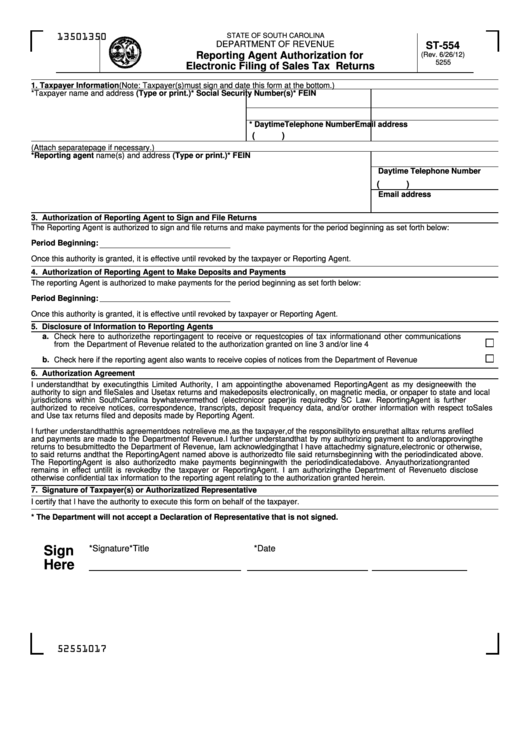

Form St-554 - Reporting Agent Authorization For Electronic Filing Of Sales Tax Returns

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

ST-554

Reporting Agent Authorization for

(Rev. 6/26/12)

5255

Electronic Filing of Sales Tax Returns

1. Taxpayer Information (Note: Taxpayer(s) must sign and date this form at the bottom.)

* Taxpayer name and address (Type or print.)

* Social Security Number(s)

* FEIN

* Daytime Telephone Number

Email address

(

)

2. Reporting Agent Information (Attach separate page if necessary.)

* Reporting agent name(s) and address (Type or print.)

* FEIN

Daytime Telephone Number

(

)

Email address

3. Authorization of Reporting Agent to Sign and File Returns

The Reporting Agent is authorized to sign and file returns and make payments for the period beginning as set forth below:

Period Beginning:

Once this authority is granted, it is effective until revoked by the taxpayer or Reporting Agent.

4. Authorization of Reporting Agent to Make Deposits and Payments

The reporting Agent is authorized to make payments for the period beginning as set forth below:

Period Beginning:

Once this authority is granted, it is effective until revoked by taxpayer or Reporting Agent.

5. Disclosure of Information to Reporting Agents

a.

Check here to authorize the reporting agent to receive or request copies of tax information and other communications

..............................................

from the Department of Revenue related to the authorization granted on line 3 and/or line 4

..........................

b.

Check here if the reporting agent also wants to receive copies of notices from the Department of Revenue

6. Authorization Agreement

I understand that by executing this Limited Authority, I am appointing the above named Reporting Agent as my designee with the

authority to sign and file Sales and Use tax returns and make deposits electronically, on magnetic media, or on paper to state and local

jurisdictions within South Carolina by whatever method (electronic or paper) is required by SC Law. Reporting Agent is further

authorized to receive notices, correspondence, transcripts, deposit frequency data, and/or or other information with respect to Sales

and Use tax returns filed and deposits made by Reporting Agent.

I further understand that this agreement does not relieve me, as the taxpayer, of the responsibility to ensure that all tax returns are filed

and payments are made to the Department of Revenue. I further understand that by my authorizing payment to and/or approving the

returns to be submitted to the Department of Revenue, I am acknowledging that I have attached my signature, electronic or otherwise,

to said returns and that the Reporting Agent named above is authorized to file said returns beginning with the period indicated above.

The Reporting Agent is also authorized to make payments beginning with the period indicated above. Any authorization granted

remains in effect until it is revoked by the taxpayer or Reporting Agent. I am authorizing the Department of Revenue to disclose

otherwise confidential tax information to the reporting agent relating to the authorization granted herein.

7. Signature of Taxpayer(s) or Authorizatized Representative

I certify that I have the authority to execute this form on behalf of the taxpayer.

* The Department will not accept a Declaration of Representative that is not signed.

*Signature

*Title

*Date

Sign

Here

52551017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2