Form Ri-2220 - Underpayment Of Estimated Tax By Corporations

ADVERTISEMENT

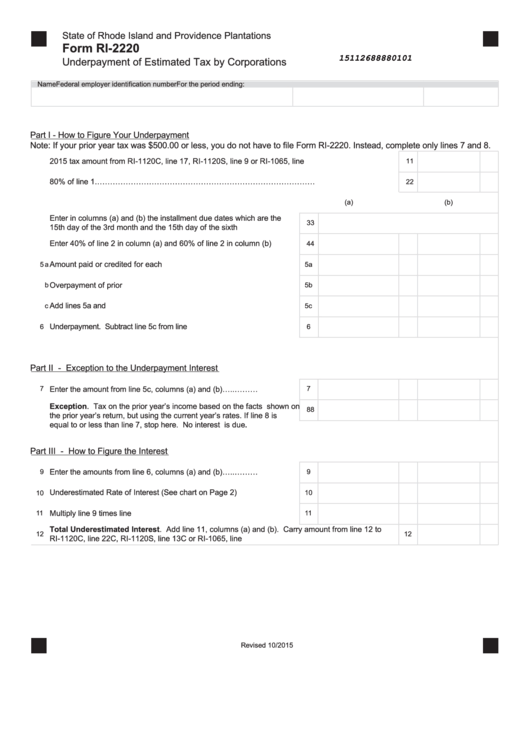

State of Rhode Island and Providence Plantations

Form RI-2220

15112688880101

Underpayment of Estimated Tax by Corporations

Name

Federal employer identification number

For the period ending:

Part I - How to Figure Your Underpayment

Note: If your prior year tax was $500.00 or less, you do not have to file Form RI-2220. Instead, complete only lines 7 and 8.

2015 tax amount from RI-1120C, line 17, RI-1120S, line 9 or RI-1065, line 9.........................................

1

1

2

80% of line 1.…………………………………………………………………………......................................

2

(a)

(b)

Enter in columns (a) and (b) the installment due dates which are the

3

3

15th day of the 3rd month and the 15th day of the sixth month................

Enter 40% of line 2 in column (a) and 60% of line 2 in column (b)............

4

4

Amount paid or credited for each period...................................................

5

a

5a

b

Overpayment of prior installment...............................................................

5b

Add lines 5a and 5b.........................................................................................

c

5c

Underpayment. Subtract line 5c from line 4...................................................

6

6

Part II - Exception to the Underpayment Interest

7

7

Enter the amount from line 5c, columns (a) and (b)…..………..................

Exception. Tax on the prior year’s income based on the facts shown on

8

8

the prior year’s return, but using the current year’s rates. If line 8 is

equal to or less than line 7, stop here. No interest is due

.

Part III - How to Figure the Interest

Enter the amounts from line 6, columns (a) and (b)…..………..................

9

9

Underestimated Rate of Interest (See chart on Page 2)...........................

10

10

Multiply line 9 times line 10.......................................................................

11

11

Total Underestimated Interest. Add line 11, columns (a) and (b). Carry amount from line 12 to

12

12

RI-1120C, line 22C, RI-1120S, line 13C or RI-1065, line 13C.................................................................

Revised 10/2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1