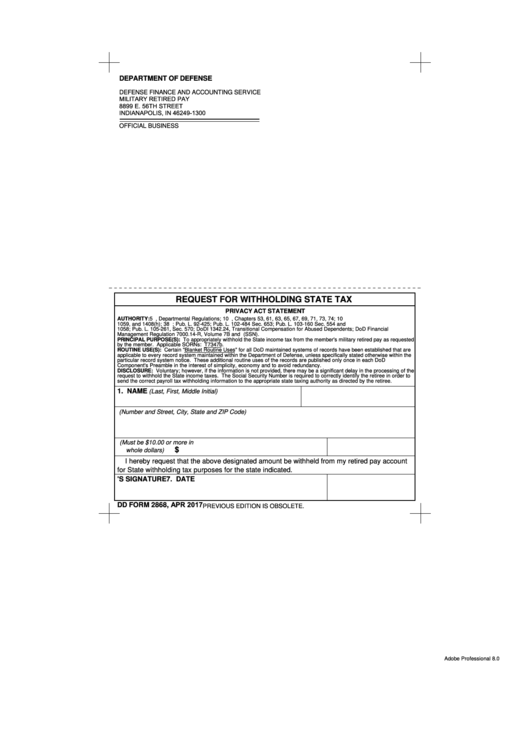

DEPARTMENT OF DEFENSE

DEFENSE FINANCE AND ACCOUNTING SERVICE

U.S. MILITARY RETIRED PAY

8899 E. 56TH STREET

INDIANAPOLIS, IN 46249-1300

OFFICIAL BUSINESS

REQUEST FOR WITHHOLDING STATE TAX

PRIVACY ACT STATEMENT

AUTHORITY: 5 U.S.C. 301, Departmental Regulations; 10 U.S.C., Chapters 53, 61, 63, 65, 67, 69, 71, 73, 74; 10 U.S.C. Sec.

1059, and 1408(h); 38 U.S.C. Sec. 1311 and 1313; Pub. L. 92-425; Pub. L. 102-484 Sec. 653; Pub. L. 103-160 Sec. 554 and

1058; Pub. L. 105-261, Sec. 570; DoDI 1342.24, Transitional Compensation for Abused Dependents; DoD Financial

Management Regulation 7000.14-R, Volume 7B and E.O. 9397 (SSN).

PRINCIPAL PURPOSE(S): To appropriately withhold the State income tax from the member's military retired pay as requested

by the member. Applicable SORNs: T7347b.

ROUTINE USE(S): Certain "Blanket Routine Uses" for all DoD maintained systems of records have been established that are

applicable to every record system maintained within the Department of Defense, unless specifically stated otherwise within the

particular record system notice. These additional routine uses of the records are published only once in each DoD

Component's Preamble in the interest of simplicity, economy and to avoid redundancy.

DISCLOSURE: Voluntary; however, if the information is not provided, there may be a significant delay in the processing of the

request to withhold the State income taxes. The Social Security Number is required to correctly identify the retiree in order to

send the correct payroll tax withholding information to the appropriate state taxing authority as directed by the retiree.

1. NAME

2. SOCIAL SECURITY NUMBER

(Last, First, Middle Initial)

3. CURRENT RESIDENCE ADDRESS

(Number and Street, City, State and ZIP Code)

4. AMOUNT FOR WITHHOLDING TAX

5. DESIGNATED STATE

(Must be $10.00 or more in

$

whole dollars)

I hereby request that the above designated amount be withheld from my retired pay account

for State withholding tax purposes for the state indicated.

6. RETIREE'S SIGNATURE

7. DATE

DD FORM 2868, APR 2017

PREVIOUS EDITION IS OBSOLETE.

Adobe Professional 8.0

1

1 2

2