Business Name:

FINANCE AND ADMINISTRATIVE SERVICES DEPARTMENT

Account Number:

REVENUE AND BUDGET DIVISION

Report Period Ending Date:

CITY OF ENGLEWOOD

01/20/1900

Date Due:

Today's Date:________________

07/29/2015

1000 ENGLEWOOD PARKWAY

ENGLEWOOD, CO 80110-2373

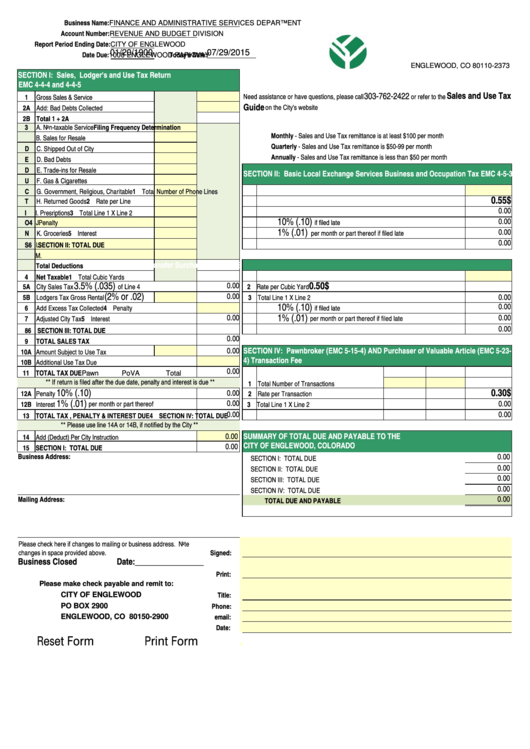

SECTION I: Sales, Lodger's and Use Tax Return

EMC 4-4-4 and 4-4-5

Sales and Use Tax

303-762-2422

Need assistance or have questions, please call

or refer to the

1

Gross Sales & Service

Guide

on the City's website

2A Add: Bad Debts Collected

2B Total 1 + 2A

3

A. Non-taxable Service

Filing Frequency Determination

Monthly - Sales and Use Tax remittance is at least $100 per month

B. Sales for Resale

Quarterly - Sales and Use Tax remittance is $50-99 per month

D

C. Shipped Out of City

Annually - Sales and Use Tax remittance is less than $50 per month

E

D. Bad Debts

D

E. Trade-ins for Resale

SECTION II: Basic Local Exchange Services Business and Occupation Tax EMC 4-5-3

U

F. Gas & Cigarettes

C

1 Total Number of Phone Lines

G. Government, Religious, Charitable

$

0.55

T

H. Returned Goods

2 Rate per Line

0.00

I

I. Presriptions

3 Total Line 1 X Line 2

10% (.10)

0.00

O

J.

4 Penalty

if filed late

1% (.01)

0.00

N

5 Interest

per month or part thereof if filed late

K. Groceries

0.00

S

6 SECTION II: TOTAL DUE

L.

M.

SECTION III: Waste Transfer Surcharge EMC 4-7-3

Total Deductions

4

Net Taxable

1 Total Cubic Yards

3.5% (.035)

$

0.50

0.00

5A City Sales Tax

of Line 4

2 Rate per Cubic Yard

(2% or .02)

0.00

0.00

5B Lodgers Tax Gross Rental

3 Total Line 1 X Line 2

10% (.10)

0.00

6

4 Penalty

if filed late

Add Excess Tax Collected

1% (.01)

0.00

0.00

7

Adjusted City Tax

5 Interest

per month or part thereof if filed late

0.00

8

6 SECTION III: TOTAL DUE

0.00

9

TOTAL SALES TAX

0.00

SECTION IV: Pawnbroker (EMC 5-15-4) AND Purchaser of Valuable Article (EMC 5-23-

10A Amount Subject to Use Tax

4) Transaction Fee

10B Additional Use Tax Due

0.00

11 TOTAL TAX DUE

Pawn

PoVA

Total

** If return is filed after the due date, penalty and interest is due **

1 Total Number of Transactions

10% (.10)

$

0.30

0.00

12A Penalty

2 Rate per Transaction

1% (.01)

0.00

0.00

12B Interest

per month or part thereof

3 Total Line 1 X Line 2

0.00

0.00

13 TOTAL TAX , PENALTY & INTEREST DUE

4 SECTION IV: TOTAL DUE

** Please use line 14A or 14B, if notified by the City **

SUMMARY OF TOTAL DUE AND PAYABLE TO THE

0.00

14 Add (Deduct) Per City Instruction

CITY OF ENGLEWOOD, COLORADO

0.00

15 SECTION I: TOTAL DUE

Business Address:

0.00

SECTION I: TOTAL DUE

0.00

SECTION II: TOTAL DUE

0.00

SECTION III: TOTAL DUE

0.00

SECTION IV: TOTAL DUE

0.00

Mailing Address:

TOTAL DUE AND PAYABLE

Please check here if changes to mailing or business address. Note

Signed:

changes in space provided above.

Business Closed

Date:_________________

Print:

Please make check payable and remit to:

Title:

CITY OF ENGLEWOOD

Phone:

PO BOX 2900

email:

ENGLEWOOD, CO 80150-2900

Date:

Reset Form

Print Form

1

1