PRINT

CLEAR

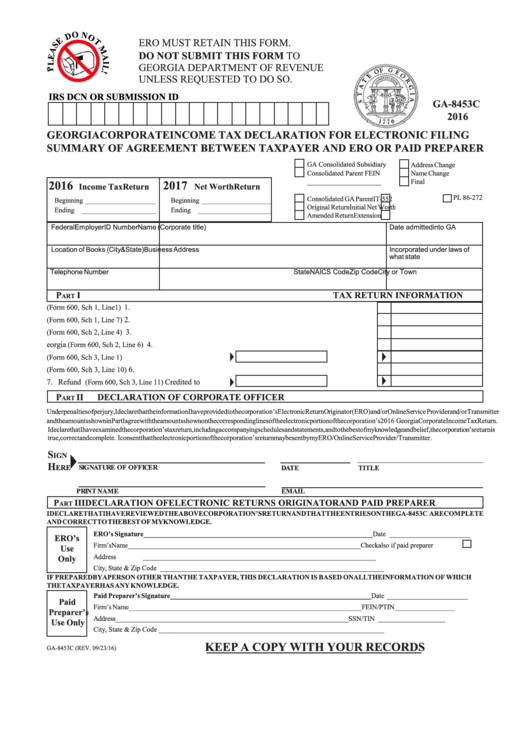

ERO MUST RETAIN THIS FORM.

DO NOT SUBMIT THIS FORM TO

GEORGIA DEPARTMENT OF REVENUE

UNLESS REQUESTED TO DO SO.

IRS DCN OR SUBMISSION ID

GA-8453C

2016

GEORGIA CORPORATE INCOME TAX DECLARATION FOR ELECTRONIC FILING

SUMMARY OF AGREEMENT BETWEEN TAXPAYER AND ERO OR PAID PREPARER

GA Consolidated Subsidiary

Address Change

Consolidated Parent FEIN

Name Change

2017

_____________________

Final

2016

Income Tax Return

Net Worth Return

PL 86-272

Consolidated GA Parent

IT-552

Beginning ____________________

Beginning ____________________

Original Return

Initial Net Worth

Ending

_____________________

Ending

_____________________

Amended Return

Extension

Federal Employer ID Number

Name (Corporate title)

Date admitted into GA

Location of Books (City & State)

Business Address

Incorporated under laws of

what state

Telephone Number

City or Town

State

Zip Code

NAICS Code

P

I

TAX RETURN INFORMATION

ART

1. Federal taxable income

1.

(Form 600, Sch 1, Line 1) ......................................................................................

2. Georgia taxable income

2.

(Form 600, Sch 1, Line 7) .....................................................................................

3. Net Worth

3.

(Form 600, Sch 2, Line 4) ............................................................................................................

4. Net Worth Taxable by Georgia

4.

(Form 600, Sch 2, Line 6) ..........................................................................

5. Tax Amounts

Income

..... Net Worth

(Form 600, Sch 3, Line 1) ............

6. Balance of Tax due with return

(Form 600, Sch 3, Line 10)........................................................................

6.

7. Refund

Credited to 2017

...... Refunded

(Form 600, Sch 3, Line 11) ....

P

II

DECLARATION OF CORPORATE OFFICER

ART

Underpenaltiesofperjury, Ideclare that the informationIhaveprovidedto the corporation’sElectronicReturnOriginator(ERO)and/orOnline Service Providerand/orTransmitter

andthe amountsshownin Part Iagree withthe amountsshownonthe correspondinglinesofthe electronicportionofthe corporation’s2016 Georgia CorporateIncomeTaxReturn.

IdeclarethatIhave examinedthe corporation’staxreturn,includingaccompanyingschedulesandstatements,andtothebest ofmyknowledge andbelief,the corporation’sreturnis

true,correct and complete. Iconsent that the electronicportion ofthe corporation’sreturn may be sent bymyERO/Online ServiceProvider/Transmitter.

S

IGN

H

SIGNATURE OF OFFICER

ERE

DATE

TITLE

PRINT NAME

EMAIL

P

III

DECLARATION OF ELECTRONIC RETURNS ORIGINATOR AND PAID PREPARER

ART

I DECLARE THAT I HAVE REVIEWED THEABOVE CORPORATION’S RETURNAND THAT THE ENTRIES ONTHE GA-8453C ARE COMPLETE

AND CORRECTTO THE BEST OF MYKNOWLEDGE.

ERO’s Signature _________________________________________________________________

Date _______________________

ERO’s

Firm’s Name

__________________________________________________________________

Check also if paid preparer

Use

Address

__________________________________________________________________

Only

City, State & Zip Code ________________________________________________________________

IF PREPARED BYA PERSON OTHER THAN THE TAXPAYER, THIS DECLARATION IS BASED ON ALL THE INFORMATION OF WHICH

THE TAXPAYER HAS ANY KNOWLEDGE.

Paid Preparer’s Signature _________________________________________________________

Date _______________________

Paid

Firm’s Name

__________________________________________________________________

FEIN/PTIN _________________

Preparer’s

Address

__________________________________________________________________

SSN/TIN ___________________

Use Only

City, State & Zip Code ________________________________________________________________

KEEP A COPY WITH YOUR RECORDS

GA-8453C (REV. 09/23/16)

1

1