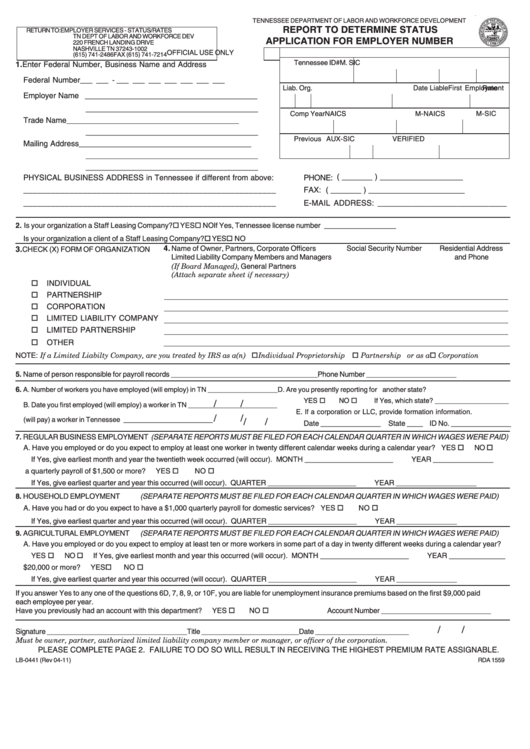

Form Lb-0441 - Report To Determine Status Application For Employer Number - Tennessee Department Of Labor And Workforce Development

ADVERTISEMENT

TENNESSEE DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT

REPORT TO DETERMINE STATUS

RETURN TO:

EMPLOYER SERVICES - STATUS/RATES

TN DEPT OF LABOR AND WORKFORCE DEV

APPLICATION FOR EMPLOYER NUMBER

220 FRENCH LANDING DRIVE

NASHVILLE TN 37243-1002

OFFICIAL USE ONLY

(615) 741-2486

FAX (615) 741-7214

Tennessee ID#

M. No.

SIC

County

Area

1. Enter Federal Number, Business Name and Address

Federal Number

___ ___ - ___ ___ ___ ___ ___ ___ ___

Liab. Org.

First Employment

Date Liable

Rate

Employer Name _______________________________________

_______________________________________

M-SIC

Comp Year

NAICS

M-NAICS

Trade Name

_______________________________________

_______________________________________

Previous No.

ROC

AUX-SIC

VERIFIED

Mailing Address _______________________________________

_______________________________________

_______________________________________

( _______ ) ___________________

PHYSICAL BUSINESS ADDRESS in Tennessee if different from above:

PHONE:

_______________________________________________________

FAX: ( _______ ) ______________________

_______________________________________________________

E-MAIL ADDRESS: _____________________________

2. Is your organization a Staff Leasing Company?

YES

NO

If Yes, Tennessee license number __________________

Is your organization a client of a Staff Leasing Company?

YES

NO

4.

Name of Owner, Partners, Corporate Officers

Social Security Number

Residential Address

3.

CHECK (X) FORM OF ORGANIZATION

Limited Liability Company Members and Managers

and Phone

(If Board Managed), General Partners

(Attach separate sheet if necessary)

INDIVIDUAL

PARTNERSHIP

CORPORATION

LIMITED LIABILITY COMPANY

LIMITED PARTNERSHIP

OTHER

NOTE: If a Limited Liabilty Company, are you treated by IRS as a(n)

Individual Proprietorship

Partnership or as a

Corporation

5. Name of person responsible for payroll records _____________________________________

Phone Number _______________________

6.

A. Number of workers you have employed (will employ) in TN __________________

D. Are you presently reporting for U.I. purposes in another state?

YES

NO

If Yes, which state? ___________________

/

/

B. Date you first employed (will employ) a worker in TN _______________________

E. If a corporation or LLC, provide formation information.

/

/

C. Date you first paid (will pay) a worker in Tennessee _______________________

/

/

Date _______________ State ____

ID No. _______________

7. REGULAR BUSINESS EMPLOYMENT (SEPARATE REPORTS MUST BE FILED FOR EACH CALENDAR QUARTER IN WHICH WAGES WERE PAID)

A. Have you employed or do you expect to employ at least one worker in twenty different calendar weeks during a calendar year? YES

NO

If Yes, give earliest month and year the twentieth week occurred (will occur). MONTH ______________________

YEAR _______________

B. Have you had or do you expect to have a quarterly payroll of $1,500 or more?

YES

NO

If Yes, give earliest quarter and year this occurred (will occur). QUARTER ______________________

YEAR ____________________

(SEPARATE REPORTS MUST BE FILED FOR EACH CALENDAR QUARTER IN WHICH WAGES WERE PAID)

8. HOUSEHOLD EMPLOYMENT

A. Have you had or do you expect to have a $1,000 quarterly payroll for domestic services? YES

NO

If Yes, give earliest quarter and year this occurred (will occur). QUARTER ______________________

YEAR _______________

(SEPARATE REPORTS MUST BE FILED FOR EACH CALENDAR QUARTER IN WHICH WAGES WERE PAID)

9. AGRICULTURAL EMPLOYMENT

A. Have you employed or do you expect to employ at least ten or more workers in some part of a day in twenty different weeks during a calendar year?

YES

NO

If Yes, give earliest month and year this occurred (will occur). MONTH ______________________

YEAR ______________

B. Have you had or do you expect to have a quarterly payroll of $20,000 or more?

YES

NO

If Yes, give earliest quarter and year this occurred (will occur). QUARTER ______________________

YEAR _______________

If you answer Yes to any one of the questions 6D, 7, 8, 9, or 10F, you are liable for unemployment insurance premiums based on the first $9,000 paid

each employee per year.

Have you previously had an account with this department?

YES

NO

Account Number ____________________________

/

/

Signature ____________________________________

Title _________________________

Date ________________________

Must be owner, partner, authorized limited liability company member or manager, or officer of the corporation.

PLEASE COMPLETE PAGE 2. FAILURE TO DO SO WILL RESULT IN RECEIVING THE HIGHEST PREMIUM RATE ASSIGNABLE.

LB-0441 (Rev 04-11)

RDA 1559

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4